By Michael Roberts

Back in July, I wrote a post on a new approach to a world rate of profit and how to measure it. I won’t go over the arguments again as you can read that post and previous ones on the subject. But in that July post, I said I would follow up on the decomposition of the world rate of profit and the factors driving it. And I would try to relate the change in the rate of profit to the regularity and intensity of crises in the capitalist mode of production. And I would consider the question of whether, if there is a tendency for the rate of profit to fall, as Marx argued, it could reach zero eventually; and what does that tell us about capitalism itself? I am not sure I can answer all those points in this post, but here goes.

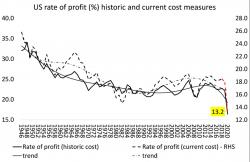

First, let me repeat the results of the measurement of a world rate of profit offered in the July post. Based on data now available in Penn World Tables 9.1 (IRR series), I calculated that the average (weighted) rate of profit on fixed assets for the top G20 economies from 1950 to 2017 (latest data).

The post-war ‘golden age’

I have divided the series into four periods that I think define different situations in the world capitalist economy. There is the ‘golden age’ immediately after WW2, where profitability is high and even rising. Then there is the now well-documented (and not disputed) collapse in the rate of profit from the mid-1960s to the global slump of the early 1980s. Then there is the so-called neoliberal recovery, where profitability recovers, but peaks in the late 1990s at a level still well below the golden age. And finally, there is the period that I call the Long Depression, where profitability heads back down, with a jerk up from the mild recession of 2001 to 2007, just before the Great Recession. Recovery in profitability since the end of the GR has been miniscule.

So Marx’s law of profitability is justified empirically. But is it justified theoretically? Could there be other reasons for the secular fall in profitability than those proposed by Marx. Marx’s theory was that capitalists competing with each other to increase profits and gain market share, would try to undercut their rivals by reducing costs, particularly labour costs. So investment in machinery and technology would be aimed at shedding labour – machines to replace workers. But as new value depends on labour power (machines do not create value without labour power), there would be a tendency for new value (and particularly surplus value) to fall relatively to the increase in investment in machinery and plant (constant capital in Marx’s terms).

Organic composition of capital

So over time, there would be a rise in constant capital relative to investment in labour (variable capital) ie a rise in the organic composition of capital (OCC). This was the key tendency in Marx’s law of profitability. This tendency could be counteracted if capitalists could force up the rate of exploitation (or surplus value) from the employed workforce. Thus, if the organic composition of capital rises more than the rate of surplus value, the rate of profit will fall – and vice versa. If this applies to the rate of profit as measured, it lends support to Marx’s explanation of the falling rate of profit since 1950.

Well, a graph of the decomposition of the rate of profit for the G20 economies shows that the long-term decline in profitability is matched by a long-term rise in the OCC. So Marx’s main explanation for a falling rate of profit, namely a rise in the organic composition of capital is supported.

What about the rate of surplus value? If that rises faster than the OCC, the rate of profit should rise and vice versa. Well, the variables broken down into the four periods I described above show the percentage change in each period. For the whole period 1950-2017, the G20 rate of profit fell over 18%, the organic composition of capital rose 12.6% and the rate of surplus value actually fell over 8%. In the golden age, the rate of profit rose 11%, because the rate of surplus value rose more (16%) than the OCC (4%). In the profitability crisis of 1966-82, the rate of profit plummeted 35% because, although the OCC also fell 6%, the rate of surplus value dropped 38%. In the neoliberal recovery period, the rate of profit rose 24% because although the OCC rose 11%, the rate of surplus value rose 37% (a real squeeze on workers’ wages and conditions). In the final period since 1997 when the rate of profit fell 10% to 2017, the OCC rose a little (4%) but the rate of surplus value dropped a little (7%).

Rate of world profit since 1950

These results confirm Marx’s law as an appropriate explanation of the movement in the world rate of profit since 1950 – I know of no other alternative explanation that explains this better.

So will the rate of profit eventually fall to zero and what does that mean? Well, if the current rate of secular fall in the G20 economies continues, it is going to take a very long time to reach zero – well into the next century! Among the G7 economies, however, if the average annual fall in profitability experienced in the last 20 years or so is continued, then the G7 rate will reach zero by 2050. But of course, there could be a new period of revival in the rate of profit, probably driven by the destruction of capital values in a deep slump and by a severe restriction on labour’s share of value by reactionary governments.

Nevertheless, what the secular fall in the profitability of capital does tell you is that capitalism’s ability to develop the productive forces and take billions out of poverty and towards a world of abundance and harmony with nature is hopelessly impossible. Capitalism as a system is already past its sell-by date.

Recurring crises of production

Finally, can we relate falling profitability with regular and recurring crises of production and investment in capitalism? In my book, Marx 200, I explain that connection and in the July post I showed a close correlation between falling profitability of capital and a fall in the total mass of profits. Marx argued that, as average profitability of capital in an economy falls, capitalists compensate for this by increasing investment and production to boost the mass of profit. He called this a double edge law: falling profitability and rising profits. However, at a certain point, such is the fall in profitability that the mass of profits stops rising and starts to fall – this is the crux point for the beginning of an ‘investment strike’ leading to a slump in production, employment and eventually incomes and workers’ spending. Only when there is a sufficient reduction in costs for capitalists, bringing about a rise in profitability and profits, will the ‘business cycle’ resume.

What is happening right now? Well, as we have seen above, global profitability was already at a low point in 2017 and still below the pre-Great Recession peak. By any measured guess, it was even lower in 2019. And I have updated my measure of the mass of profits in the corporate sector of the major economies (US, UK, Germany, Japan, China). Even before the pandemic broke and the lockdowns began, global corporate profits had turned negative, suggesting a slump was on its way in 2020 anyway.

Huge profits for the ‘FAANGS’

We read about the huge profits that the large US tech and online distribution companies (FAANGS) are making. But they are the exception. Vast swathes of corporations (large and small) globally are struggling to sustain profit levels as profitability stays low and/or falls. Now the pandemic slump has driven global corporate profits down by around 25% in the first half of 2020 – a bigger fall than in the Great Recession.

Profits recovered fast after the Great Recession. It may not be so quick this time.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.

September 21, 2020