By Michael Roberts

Next weekend, the central bankers of the world meet in a slimmed down COVID annual jamboree at Jackson Hole, Wyoming US. The bankers will hear from Fed chair Jay Powell and US Treasury secretary Janet Yellen and wade though academic papers commissioned from various mainstream ‘monetary economists’.

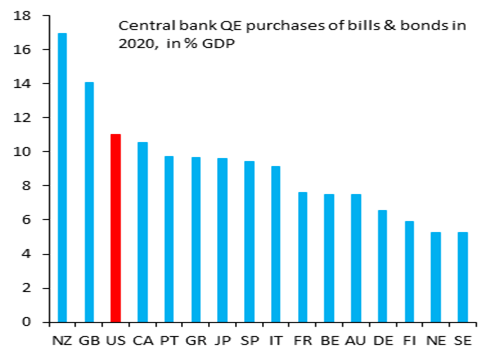

The big issue is whether it is time for central banks to wind down on their purchases of government bonds and bills designed to pump credit money into economies, which had the aim of avoiding a meltdown of businesses during the pandemic slowdown. In the COVID year of 2020, the Federal Reserve made purchases equivalent to 11% of US GDP, the Bank of England 14% of UK GDP and many other banks in the G7 of around 10% of national GDPs.

These purchases are called ‘quantitative easing’ (QE). Instead of lowering interest rates to encourage borrowing, since the onset of the Great Recession in 2008-9, central banks have gone for increasing sharply the quantity of dollars, euros, yen and pounds pumped into the banking and financial system. ‘Policy’ (ie central bank short-term) interest rates had already been driven down to zero and below. The only weapon left to central banks to stimulate economies was to ‘print’ money, in practice buying government and corporate bonds from financial institutions holding them and hoping that banks lend that cash on to firms.

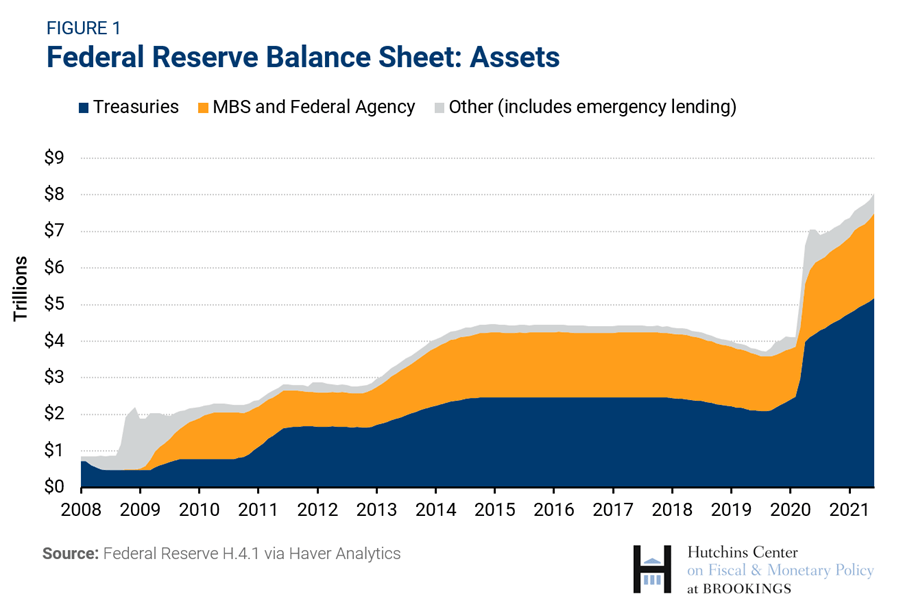

Throughout the Long Depression (as I call it) from 2009 to 2019, the level of central bank assets in these bonds rocketed. By December 2019, the assets held by the Federal Reserve in the United States were valued at 19.3 percent of the U.S. economy’s gross domestic product. This compares to 39.6 percent for the European Central bank, and 103.5 percent for the Bank of Japan (as of November 2019). And central banks have been purchasing $834 million an hour for the last 18 months. Since the start of the pandemic, the Fed’s balance sheet has more than doubled to $8tn. The European Central bank has total assets worth more than €8tn, the Bank of Japan has about $6tn, while the UK has doubled its QE programme to £895bn. Leading central banks now own more than £18tn in government bonds and other assets, an increase of more than 50% on pre-pandemic levels.

The questions facing the monetary authorities are: whether this huge increase and level of credit is a) working to keep economies growing; b) whether it is necessary any more given the supposed recovery in economies as the pandemic ends; and c) whether it is increasing the risk of a financial crash unless action is taken to curb QE.

The Fed is still buying $120bn (£88bn) a month in US government bonds and mortgage-backed securities to keep longer-term interest rates low. But the debate is underway among the Fed members about whether to keep QE going at this level to ensure recovery or whether this level of monetary injection should be curbed now before high inflation sets in, interest rates rise and a financial crash ensues. But the last time the Fed tried ‘tapering’ their monetary largesse in 2013 on the grounds that economies had recovered from the Great Recession, it led to a collapse in stock markets and in emerging market currencies increasing their debt burden. Even the just recent talk among Fed leaders on the issue took stock markets down last week.

Quantitative Easing has become ‘addictive’

And that’s the problem – it seems that banks, stock market investors and governments have become ‘addicted’ to solving their problems by getting central banks to ‘print’ more and more money. Most important, far from helping to restore productive investment and productivity growth during the Long Depression all that zero interest rates and QE have done is to boost stock and bond market levels to all-time highs. As one empirical study concluded: “output and inflation, in contrast with some previous studies, show an insignificant impact providing evidence of the limitations of the central bank’s programmes” and “the reason for the negligible economic stimulus of QE is that the money injected funded financial asset price growth more than consumption and investments.”

All the monetary injections have done is allow banks and financial speculators to build up massive amounts of what Marx called ‘fictitious capital’ ie not investment into value-creating assets in the ‘real economy’ but into stocks and bonds and cryptocurrencies – a fantasy world where a very few become billionaires while working people who don’t have stocks or even houses of their own see no increase in real incomes or wealth. QE has been a major contributor to rising inequality of incomes and wealth in the G7 economies in the last ten years.

Like the central bankers, mainstream economics is divided over whether continuing with government borrowing and quantitative easing is needed or whether continuance will lead to eventual disaster.

Different views on the future of quantitative easing

The Keynesians, post-Keynesians (including Modern Monetary Theorists) remain strongly in favour. There is no need to worry about rising government or even corporate debt. If governments resort to trying to cut back their debts as they did during the Long Depression (without much success), such an ‘austerity’ policy will only delay economic recovery and even reverse it. The Keynesians ignore the evidence that government spending and deficits have had little effect on achieving economic recovery anyway.

But in this post-COVID period, some Keynesians are pushing another argument for QE and monetary and fiscal largesse. Mark Sandbu, the European economics correspondent of the Financial Times has come up with what he calls a ‘novel idea’; namely that QE along with the sort of fiscal stimulus that US President Biden is pursuing will actually force up wages as inflation rises. This will give new bargaining power to workers and restore ‘class conflict’ in the workplace.

Sandbu recognises that employers will want to resist this situation as it might damage their profits and refers to the famous post-Keynesian paper by Michal Kalecki on why wage rises and full employment are resisted by capitalists. But Sandbu is sanguine about that conflict. Starting from the Keynesian premiss that what matters is not profits in an economy but sufficient ‘effective demand’, he reckons that rising wages “can encourage employers to increase both labour productivity and output if they expect demand growth to be strong.” So it will be possible to have “what Kalecki called full employment capitalism”, because we can promote “an enlightened view of capital owners’ self-interest”. So “far from class conflict being a zero-sum game, productivity incentives from greater worker power can boost profits as well.” So it’s the most perfect of all possible worlds: workers get higher wages and capitalists get higher profits – all thanks to QE, Bidenomics and inflation.

“Topping up the punch bowl”

This, of course, is not the view of the other side of the mainstream spectrum. These are closer to the view that governments and central banks should not intervene in markets and economies and ‘distort’ natural interest rates and cause ‘overinvestment’ in financial assets leading to a crash. In the same issue of the FT that Sanbu presented his Leibniz view of capitalist economies, John Plender was severe in his condemnation of QE and all its works. Plender remarked that “the central banks have been busy topping up the punch bowl through their continued bond purchases to keep interest rates low while conducting an interminable debate on when and how to remove support. Their protestations that the risk of inflation is “transitory” look increasingly questionable.”

Plender makes the point that “central bankers’ claims that QE would boost gross domestic product are less convincing…in the meantime, unconventional monetary policy is creating ever greater balance sheet vulnerabilities.” The Keynesians fail to recognise that, although near zero interest rates keep the cost of servicing government and corporate debt low, QE shortens the maturity of that debt. That means governments and companies are faced with renewing that debt at shorter intervals. As Plender comments: “The Bank for International Settlements estimates that 15 to 45 per cent of all advanced economy sovereign debt is now, de facto, overnight. In the short run, that yields a net interest saving to governments. But their increased exposure to floating rates heightens vulnerability to rising interest rates.”

In the advanced economies, the IMF estimates that the government debt-to-GDP ratio went from under 80 per cent in 2008 to 120 per cent in 2020. The interest bill on that debt nonetheless went down over the period, encouraging a Panglossian belief that the debt must be sustainable. A similar surge in the global non-financial corporate sector led to debt hitting a record high of 91 per cent of GDP in 2019.

Plender goes on: “Against that background, investors’ search for yield has caused severe mispricing of risk, along with widespread misallocation of capital.” In true Austrian school mode, Plender predicts that: “The trigger now may be a lethal combination of rising inflation and financial instability. The difficulty is that central banks cannot take away the punch bowl and raise rates without undermining weak balance sheets and taking a wrecking ball to the economy”.

Risk of a financial crash

Former Indian central bank governor, Raghuram Rajan, raised the same worries in a piece for the Group of 30, a not well-known association of government and central bank institutions. Entitled, the Dangers of Endless Quantitative Easing, Rajan also points out the risks of letting QE rip on. He reckons the raging desire to make money in financial markets with zero interest credit risks a financial crash down the road. His worry is also that government interest costs could rise sharply with rising inflation. “If government debt is around 125% of GDP, every percentage-point increase in interest rates translates into a 1.25 percentage-point increase in the annual fiscal deficit as a share of GDP… and what matters is not the average debt maturity, but rather the amount of debt that will mature quickly and must be rolled over at a higher rate.”

There is no doubt that net interest on government debt is currently very low historically, only slightly more than 1% of GDP a year compared to a GDP growth rate of 2-3% a year ahead. But the Peterson Institute argues that those “who believe that rates will almost certainly not rise are too confident in their own views. The forces that have contributed to lower rates are universally difficult to predict, and, as noted above, even modest changes in rates can produce sizable movements in net interest as a share of the economy in the future.”

There you have the mainstream debate. On the one hand, rising government and corporate debt is nothing to worry about because QE and fiscal stimulus will achieve economic recovery and inflation will dissipate. Moreover, rising wages might encourage capitalists to invest and so raise productivity to pay for any rise in interest rates when central banks ‘taper’ their spending. On the other hand, goes the argument that all this QE is just going into financial speculation, causing malinvestment and inflation that will only be stopped by some financial crash of disastrous proportions.

What is the Marxist view on this debate? Well, in my view, the Keynesians and Austrian are both right and wrong. Rising government debt and even rising corporate debt does not have to be a problem if economies recover to achieve and sustain a good rate of real GDP growth and profits for companies. Government debt to GDP ratios can be reduced or at least managed if GDP growth is higher than the going interest rate. So the Keynesians are right and the Austrians wrong here.

Continual rise in fictitious capital

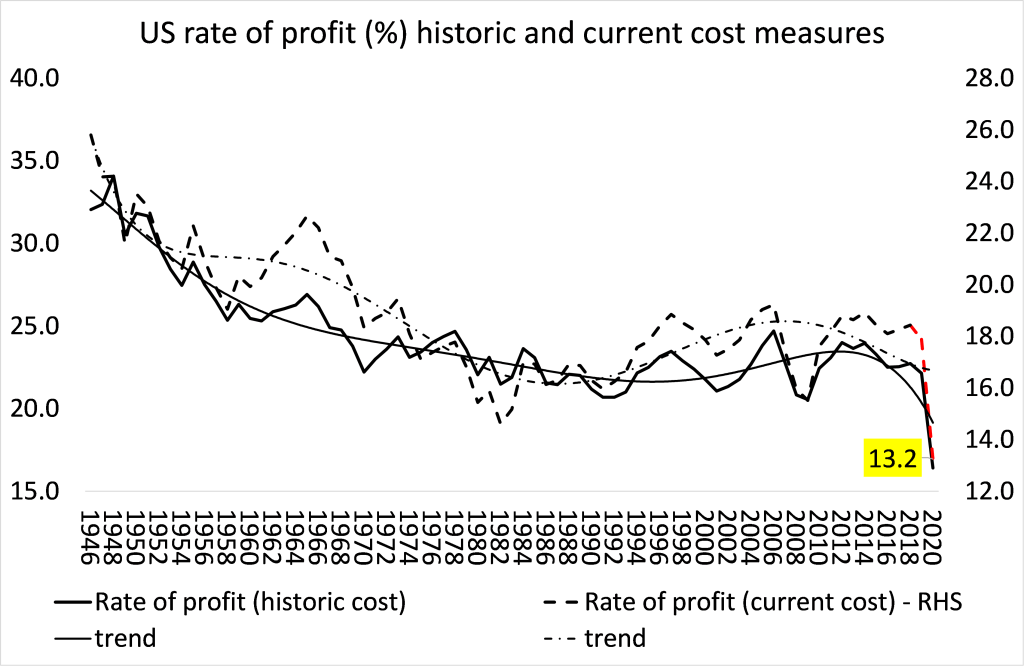

But the Austrians are right that the continual rise in fictitious capital rather than investment in productive capital is laying the basis for a crash down the road if economic recovery should falter. Once a drug user is addicted, it is difficult to wean the user off the drug while ‘cold turkey’ could kill the patient. As Plender put it: “The imperative should rather be to ensure that the post-pandemic debt splurge finds its way into productive investment.” Exactly, but how can that be done if capitalists do not want to invest productively? What decides the level of productive investment is its profitability for capitalists and its profitability compared to the ‘search for yield’ from stock and bond market speculation that QE has bred.

Let me repeat yet again the words of Michael Pettis, a firm Keynesian economist: “the bottom line is this: if the government can spend additional funds in ways that make GDP grow faster than debt, politicians don’t have to worry about runaway inflation or the piling up of debt. But if this money isn’t used productively, the opposite is true.” That’s because “creating or borrowing money does not increase a country’s wealth unless doing so results directly or indirectly in an increase in productive investment…If US companies are reluctant to invest not because the cost of capital is high but rather because expected profitability is low, they are unlikely to respond ….by investing more.”

Profitability in the productive sectors of the major economies was near an all-time low before the pandemic struck. The pandemic slump took profitability down further and no doubt it is recovering fast right now. But will profitability get up to levels that will sustain productivity-enhancing investment in the next few years, especially if wage rises start to squeeze profit margins?

That issue will not be part of the debate at Jackson Hole this week.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.