by Abigail Pollock

Child benefit used to be a bedrock of the welfare state, a benefit for those who could not work by virtue of being under 19 years of age. Christmas comes and goes, but the astute mother would have her beneficial nest-egg to fall back on. The £20 a week per child, has not been raised since the Con-Dems means-tested it back in 2013

We have been told for at least 20 years that benefits should be linked to a willingness to work and the definition of that has changed. Until the Welfare Bill of 2004 it was presumed that mothers with school-aged children were disadvantaged in the labour market. However, by stealth, with the introduction of Child Tax Credits and Working Family Tax Credits, any additional child-care costs were subsumed into the overall credit bill.

Working Tax Credits were trailed by the Blair administration in the late 90s to reward working parents with tax-breaks so they could buy child-care vouchers. This sea-change aimed to encourage mums into work and ended the notion that those with children should receive benefits to be stay-at-home parents.

Working Tax Credits were rebates to all those who could not make full-time employment cover living. So, a disabled person or a single mum had to work a minimum of 16 hours to get income support. Child Tax Credits were primarily to pay for child-care so were claimed by mothers working the full 35-hour week that schools and state nurseries could not cover, they began in April 2003 and have now been absorbed into Universal Credit this has been a disaster and a drop in income for most mothers.

In 2013 the Daily Mail ran several front-page stories on families of seven or eight living on over £2,000 a month. Whilst in 2010 terms a London family would have lived high off the fat of the land on £24k a year, depreciation has whittled this down. There are few families in London now living the high life on £21k, the benefit cap, after housing costs.

Benefit reforms go straight into landlords’ pockets

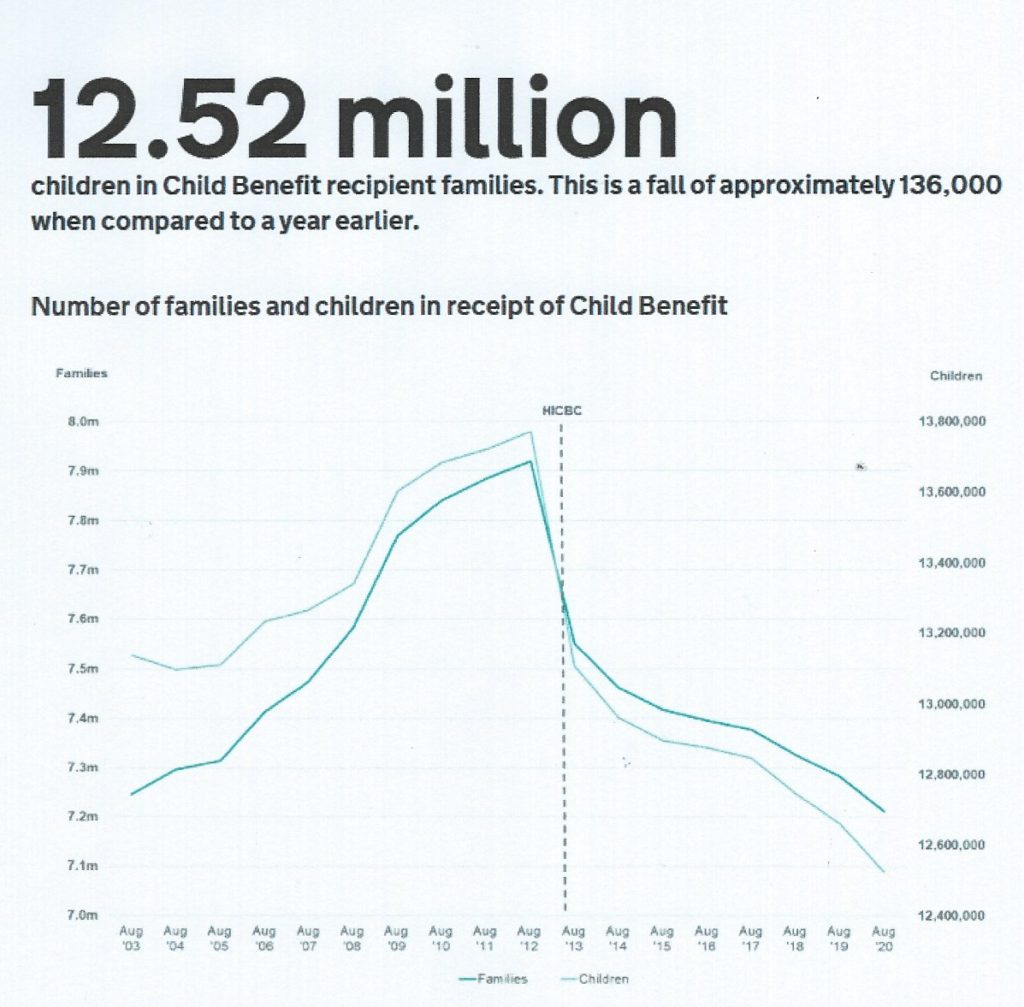

The reforms to the benefits families receive, has only fattened the pockets of private landlords and has done nothing to protect children living under austerity. A whole generation has grown up not knowing the security of a secure tenancy or indeed, protected rent. The decision to remove child benefit from families with an income of over £44k led to a campaign in 2010 to ensure that mothers can receive a direct benefit from the Department of Work and Pensions – as marriage or co-habitation does not necessarily ensure that family income reaches the child. As a result, the Government climbed down and accepted that single parents on over £44k should still receive £80 a month, particularly as a couple with two incomes of £40k were eligible with an £80k joint income.

A shibboleth of welfarism was the protection of children’s health and security for parents. Underlying this was a 1940s notion that motherhood or maternal well-being was essential to combat child poverty. The benefit began in 1979 replacing Family Allowance and has been frozen at £80 since 2010.

Single mothers labelled as scroungers

By the 1980s, with the decline in heavy industry and resulting mass unemployment, the concept of the single-mother or unmarried mothers as “scroungers” became acceptable. Furthermore, it was a cornerstone of the welfare reforms that both Thatcher and Blair entrenched. The situation now is that very few parents bother to claim the child benefit to which they are entitled . An unreported recent change this year has made it taxable to all earning over £50k.

Clearly, if there is a surplus in the public money allocated to single parents, the Government should allocate this money to raising benefits for those in need. Unfortunately the media focus has been on the Universal Credit roll-out and, quite rightly, on the impact of this on disabled people and over 50s. A tiered system which allows a family of middle-income earners to claim £80; but allows families on £21k to claim up to £200 a month, would be a fair step towards ensuring that monies for children target disadvantaged under sixteens. Put simply, if ten million families were to claim £200pm the resulting £2,400 a year would cost £24 billion. To compare this in budget terms, the education bill is £103 billion and the defence budget is £50.6 billion.

London boroughs spending to combat child poverty

In London’s schools the annual education budget is £6.2 billion. Many schools now spend huge sums on welfare measures such as breakfast clubs, uniform banks, and free computers. £344 million is the cost of Newham’s schools, the highest in London, demonstrating that a borough of child poverty requires additional spending on schools.

To empower parents and support families the so-called “Nanny State” should now divert some public spending back to mothers and carers. The rise in domestic violence, and the death of two toddlers during Lockdown, should make us ask pertinent questions about the link between family income and neglect. These questions are not being asked by the media and with the abolition of The Child Support Agency and cuts to Legal Aid the question is now – is it time to empower mothers again by rewarding their role in tackling child poverty?