By Michael Roberts

Last summer when the US fled Afghanistan, I wrote a post on the history of US dollar dominance. I argued then that the US dollar would remain the dominant world currency for the foreseeable future, but that it was in relative decline compared to other currencies, precisely because US imperialism has been in relative decline compared to other rival economies since the mid-1970s.

The Russian invasion of Ukraine has brought this discussion to the fore again among mainstream economists and strategists of global capital. The talk is that US dollar dominance will wane and that the world economy is set to divide into two blocs: west and east – with the west being the US, Europe and Japan; and the east being the ‘autocratic’ regimes of Russia and China, along with India. But is this the likely reconfiguration of currencies and capital flows?

New developments in world economic relationships

In my previous post, I dealt in detail with the historic decline in the dominance of the US dollar in trade, capital flows and as a reserve currency. I won’t go over that again. Instead, in this post, I will try and look at the future and the consequences of new developments in the competitive struggles between the imperialist powers, the ‘emergent’ economies resisting ‘western’ dominance; and the wider world of peripheral and poor countries.

International competitors to US imperialism, such as Russia and China, have routinely called for a new international financial order and have worked to displace the dollar at the apex of the current global currency regime. The addition of the renminbi in 2016 to the basket of currencies that composes the IMF’s special drawing rights represented an important global acknowledgment of the increasing international use of the Chinese currency. And the aftermath of the Ukraine conflict will clearly accelerate that drive by Russia and China as they face severe and long-standing sanctions in trade and money markets that will reduce their access to the dollar and the euro.

No real alternative to the US dollar

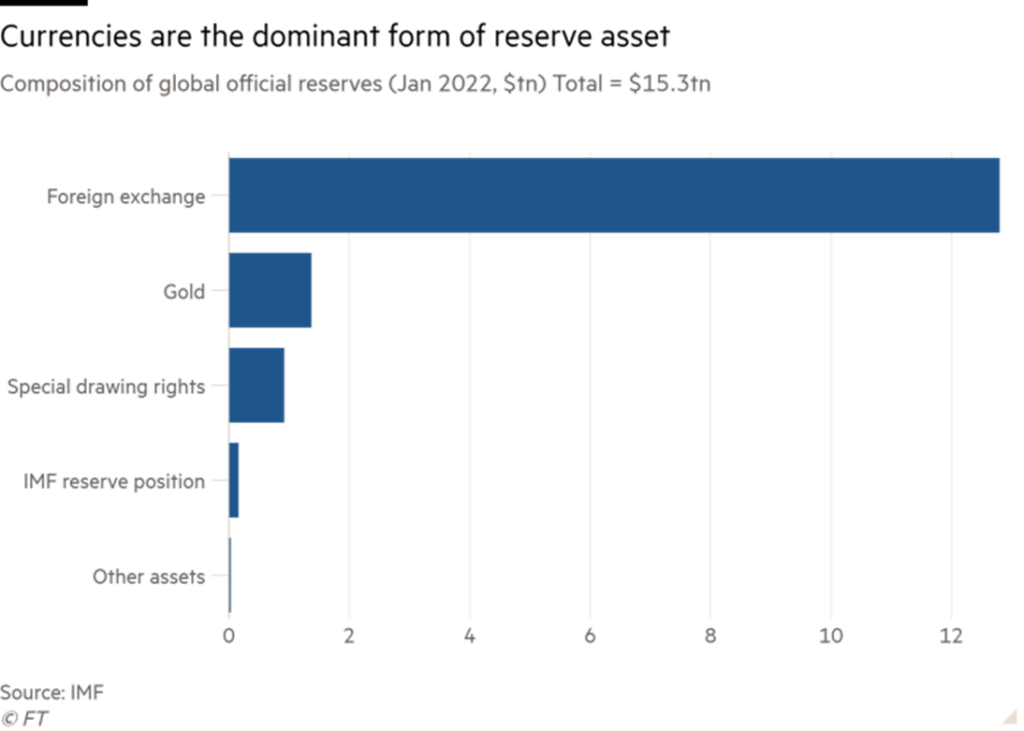

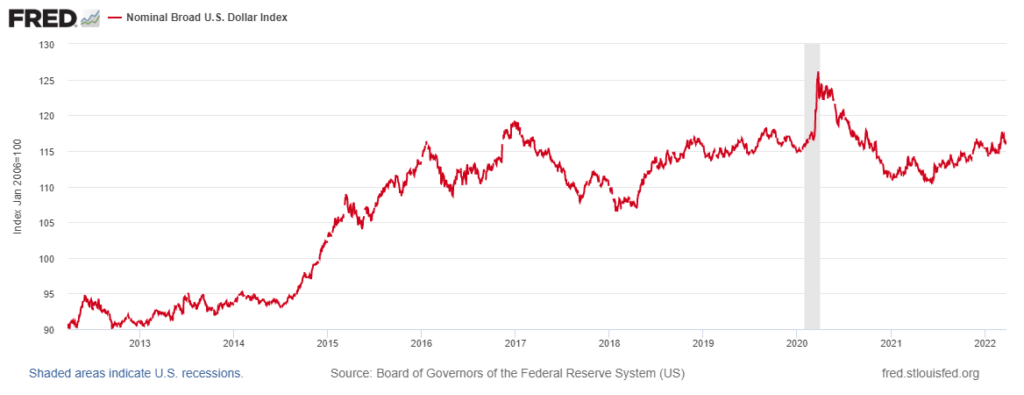

But there is still no real alternative in international markets to the US dollar. First, there can be no return to gold as the international money commodity; and the role of international money as created by the IMF in Special Drawing Rights (SDRs) is minimal; while it’s a volatile future with other potential monetary assets like cryptocurrencies.

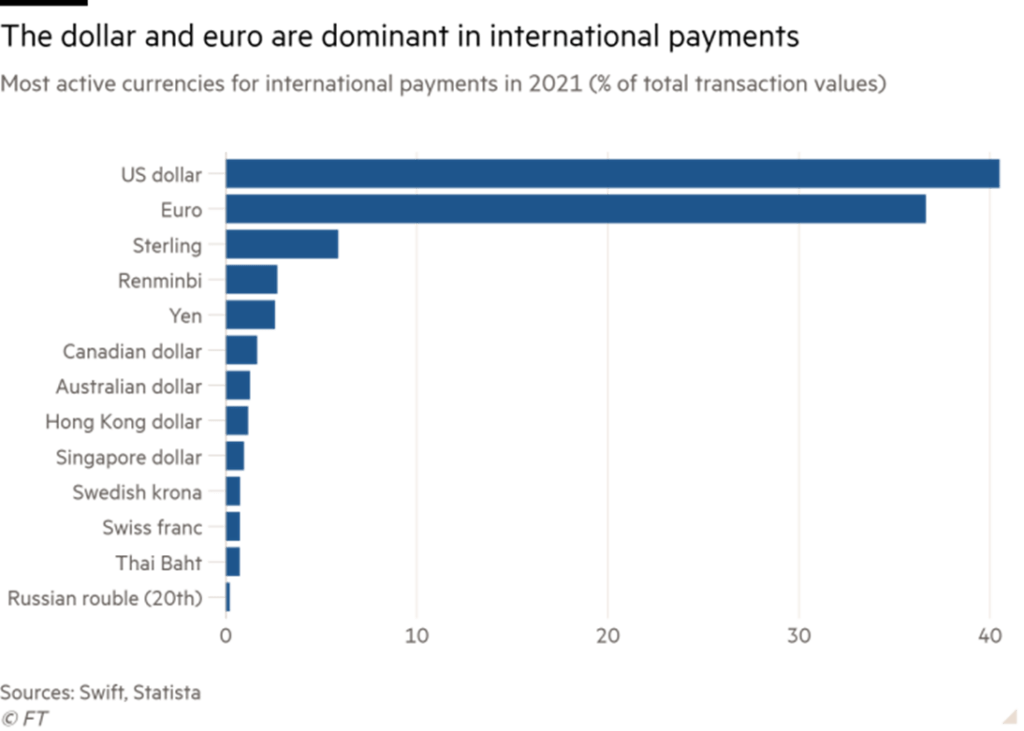

And the US dollar (and to a lesser extent the euro) remains dominant in international payments.

Gradual trend towards a batch of minor currencies

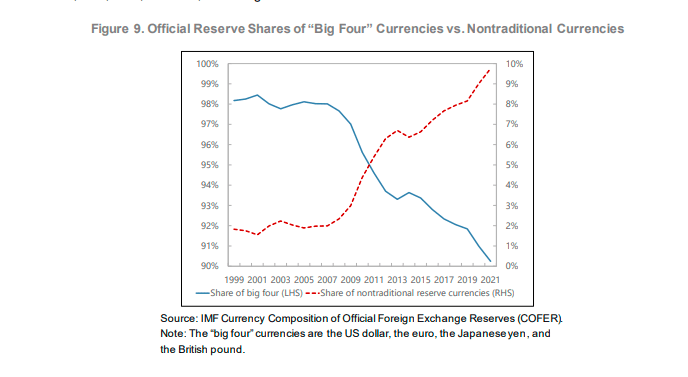

However, a recent IMF working paper does reveal an important trend. The US dollar is not being gradually replaced by the euro, or the yen, or even the Chinese renminbi, but by a batch of minor currencies. According to the IMF, the share of reserves held in U.S. dollars by central banks has dropped by 12 percentage points since the turn of the century, from 71 percent in 1999 to 59 percent in 2021. But this fall has been matched by a rise in the share of what the IMF calls ‘non-traditional reserve currencies’, defined as currencies other than the ‘big four’ of the US dollar, euro, Japanese yen and British pound sterling, namely such as the Australian dollar, Canadian dollar, Chinese renminbi, Korean won, Singapore dollar, and Swedish krona.

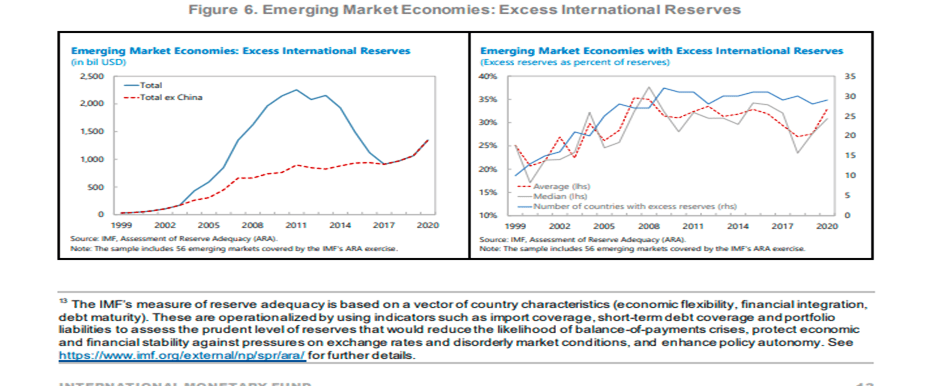

The IMF found that this shift to ‘non-traditional currencies was broad based: “we identify 46 active diversifiers that have shifted their portfolios in this direction, such that they now hold at least 5 percent of their reserves in non-traditional currencies.” Countries that build up what the IMF calls ‘excess’ Foreign Exchange (FX) reserves, ie over and above that necessary to deal with any trade or currency crisis, are increasingly diverting that excess away from the ‘big four’ currencies of dollars, euros, sterling and yen and into other smaller currencies. The IMF reckons that excess FX reserves now add up to $1.5trn (including China), or 25-30% of total reserves in the non-imperialist economies.

El Salvador resorts to cryptocurrencies

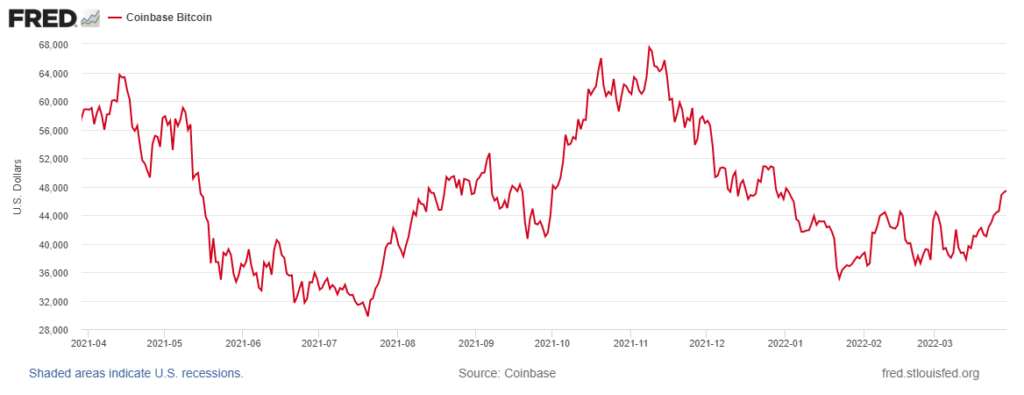

Then there are the countries that do not have ‘excess’ reserves but on the contrary, have scarce dollar FX reserves. Some of these have also resorted to alternative currency assets like cryptocurrencies (El Salvador and Nigeria). For example, a year ago, El Salvador adopted bitcoin as legal tender and has now announced the issuance of a government bond to be paid in bitcoin. These so-called ‘volcano’ bonds (El Salvador is volcanic), are designed to raise funds for the government and investors by eventually selling the bonds for dollars in five years. Of course, all depends on the dollar value of bitcoin rising by then. But look at the volatility in bitcoin’s dollar rate in the last year.

All this suggests that the shift in international currency strength after the Ukraine war will not lead into some West-East bloc, as most argue, but instead towards a fragmentation of currency reserves; to quote the IMF: “if dollar dominance comes to an end (a scenario, not a prediction), then the greenback could be felled not by the dollar’s main rivals but by a broad group of alternative currencies”. That may have even worse consequences for world peace and for the smooth expansion of the world capitalist economy than a major split between west and east. Indeed, it implies almost an anarchic currency situation where the imperialist economies, particularly the US, could lose control over world currency markets.

Hopes for a new “Bretton Woods” are misplaced

It also implies that Keynesian hopes for a new coordinated world order in global money, trade and finance is ruled out. Kevin Gallagher and Richard Kozil-Wright, leftist economists in UNCTAD (United Nations Conference for Trade and Development), in a new book, The Case for a New Bretton Woods, argue that in the aftermath of COVID, governments have the opportunity to implement sweeping reforms to “(boldly) rewrite the rules to promote a prosperous, just, and sustainable post-Covid world economic order – a Bretton Woods moment for the 21st century,” or “we risk being engulfed by climate chaos and political dysfunction.”

The authors hark back to the Keynesian-inspired Bretton Woods agreement that set international rules for harmonious trade and capital flows that countries would follow. Bretton Woods was apparently a great success in the first two post-1945 decades of prosperity and growth. The authors reckon that big finance capital was not involved in the agreement, which instead was an international follow-up to the very successful New Deal programme for employment and growth instituted by US President Roosevelt to end the Great Depression of the 1930s – “Washington’s attempt to internationalise the New Deal”. Gallagher and Kozul-Wright note: “The New Deal programme not only abandoned the gold standard, but also broke with the wider liberal international agenda by taking on the financial elite both at home and abroad and opened the door to an alternative narrative in support of an activist public policy agenda.” The authors claim that this is the model that we must return to bring about harmonious and even expansion of the world economy from hereon. “It provides a blueprint for change that no one interested in the future of our planet can afford to miss.”

Unfortunately, this ‘blueprint’ is not going to happen in the 21st century – on the contrary. The Bretton Woods agreement was only possible because, in 1944, the US ruled the world and could dictate the terms for international trade, payments and currency controls. And the first two decades after 1944 were a period of high profitability of capital in the major economies that allowed all participants to gain (if unevenly) from the spoils of cheap labour globally (at the expense of the so-called Third World, which had no say in Bretton Woods) and from the introduction of new technologies developed during the war.

Changed conditions of global capitalism

But as Marxist theory has proven, this ‘golden age’ could not last once the profitability of capital started to fall and when US dominance in trade and capital flows began to wane. The end of Bretton Woods was a product of changing conditions for global capital. it was not because of a change of economic ideology from Keynesian international macro management to ‘neoliberal’ free markets in currencies and trade. It was the change in economic conditions that forced a change in the ideology of economics and politicians to ‘free markets’, floating currencies and deregulation of trade and capital flows (globalisation).

A revival of a new ‘Bretton Woods’ is not possible in the 21st century. There is increasingly no dominant economic power that can dictate terms to others; and this is no ‘golden age’ of high profitability that all the major economies can share in. On the contrary, the profitability of capital in the major economies is near 50-year lows and the dominance of the big four currencies in world capitalist markets is fragmenting into a myriad of small currency regimes (as the IMF suggests).

Dollar’s relative strength in crises heralds disaster for weak economies

Don’t’ get me wrong, the dollar still sits in the driving seat in world markets. Indeed, in global slumps and in geopolitical crises, the dollar becomes the strongest among fiat currencies, alongside gold as the world’s commodity currency. And that’s especially the case when interest rates look set to rise more in the US than in other major economies.

The difference now is that rising interest rates and a strong dollar do not herald a more harmonious world capitalist economy, but instead disaster for the weaker and poorest countries globally. A recent study by the World Trade Organisation, based on measuring the dynamic impact of lost trade and technology diffusion, found that “a potential decoupling of the global trading system into two blocs – a US-centric and a China-centric bloc – would reduce global welfare in 2040 compared to a baseline by about 5%. Losses would be largest (more than 10%) in low-income regions that benefit most from positive technology spillovers from trade”. I suspect the damage to the poorest economies would be even greater in more fragmented currency world. This is something I shall take up in my next post.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.