By Michael Roberts

The Governor of the Bank of England, Andrew Bailey set the attitude of the mainstream view on the impact of inflation in February, when he said that “I’m not saying nobody gets a pay rise, don’t get me wrong. But what I am saying is, we do need to see restraint in pay bargaining, otherwise it will get out of control”.

Call for pay restraint

Bailey followed the Keynesian explanation of rising inflation as being the result of a tight (‘full employment’) labour market allowing workers to push for higher wages and thus forcing employers to hike prices to sustain profits. This ‘wage-push’ theory of inflation has been refuted both theoretically and empirically, as I have shown in several previous posts.

And more recently the Bank for International Settlements (BIS) study confirms that “by some measures, the current environment does not look conducive to such a spiral. After all, the correlation between wage growth and inflation has declined over recent decades and is currently near historical lows.”

But this wage push theory persists among orthodox Keynesians because they think full employment breeds inflation; and it is supported by the authorities because it ignores any impact on prices by businesses attempting to boost profit. Bailey did not talk about ‘restraint’ in market pricing or profits.

Origins of the ‘wage-push’ theory

The wage-push theory existed before Keynes. As far back as in the mid-19th century, the neo-Ricardian trade unionist Thomas Weston argued in the circles of the International Working Man’s Association that workers could not push for wages that were higher than the cost of subsistence because it would only lead to employers hiking prices and was therefore self-defeating. For Weston, there was an ‘iron law’ of real wages tied to the labour time required for subsistence which could not be broken.

Marx rebutted Weston’s views both theoretically and empirically in a series of speeches published in the pamphlet, Value Price and Profit. Marx argued that the value (price) of commodity ultimately depended on the average labour time taken to produce it. But that meant the shares of that labour time between the workers who created the commodity and the capitalist who owned it was not fixed but depended on the class struggle between employers and employed. As he said, “capitalists cannot raise or lower wages merely at their whim, nor can they raise prices at will in order to make up for lost profits resulting from an increase in wages.” If wages are ‘restrained’ that may not lower prices but instead simply increase profits.

Increased profits from wages being held back

Indeed, that is what is happening now in the current bout of inflation. In the Great Recession recovery, price growth was actually quite subdued over the first few years of that recovery. Corporations instead applied extreme wage suppression (aided by high and persistent levels of unemployment). Unit labour costs (ie the cost of labour per unit of production) fell over a three-year stretch from the recession’s trough in the second quarter of 2009 to the middle of 2012.

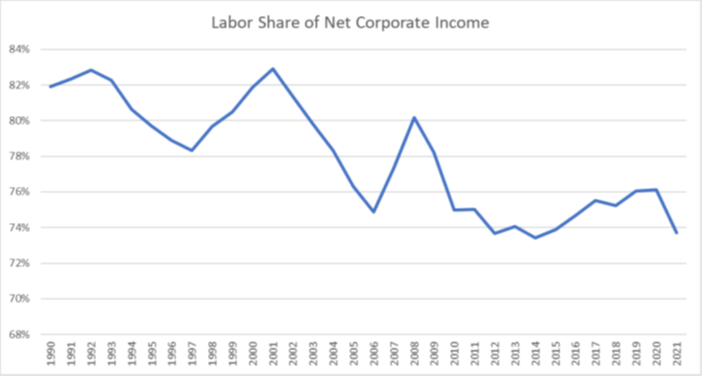

There has been a general pattern of the labour share of income falling during the early phase of recoveries characterized most of the post–World War II recoveries, though it has become more extreme in recent business cycles. By 2019, labour’s share was at all-time low. The decade of the 2010s saw basically a stagnation of average real wages in most major economies.

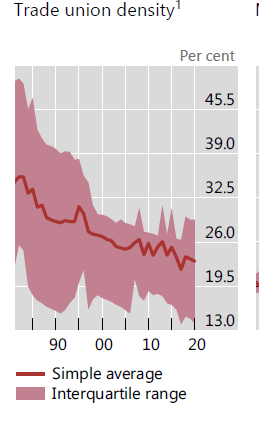

In a recent report, the Bank for International Settlements (BIS) makes the point that “in recent decades, workers’ collective bargaining power has declined alongside falling trade union membership. Relatedly, the indexation and Cost of Living Adjustment (COLA) clauses that fuelled past wage-price spirals are less prevalent. In the euro area, the share of private sector employees whose contracts involve a formal role for inflation in wage-setting fell from 24% in 2008 to 16% in 2021. COLA coverage in the United States hovered around 25% in the 1960s and rose to about 60% during the inflationary episode of the late 1970s and early 1980s, but rapidly declined to 20% by the mid-1990s “

Current reality is the opposite of the Keynesian inflation theory

Since the COVID slump, labour’s share of income and real wages have been falling sharply even as unemployment falls. This is the complete opposite of the Keynesian inflation theory and the so-called ‘iron law of wages’ proposed by Weston against Marx. The rise in inflation has not been driven by anything that looks like an overheating labour market—instead it has been driven by higher corporate profit margins and supply-chain bottlenecks. That means that central banks hiking interest rates to ‘cool down’ labour markets and reduce wage rises will have little effect on inflation and are more likely to cause stagnation in investment and consumption, thus provoking a slump.

Prices of commodities can be broken down into the three main components: labour costs (v= the value of labour power in Marxist terminology), non-labour inputs (c =the constant capital consumed) and the “mark-up” of profits over the first two components (s = surplus value appropriated by the capitalist owners). P = v + c + s.

Profit margins far outweigh labour costs

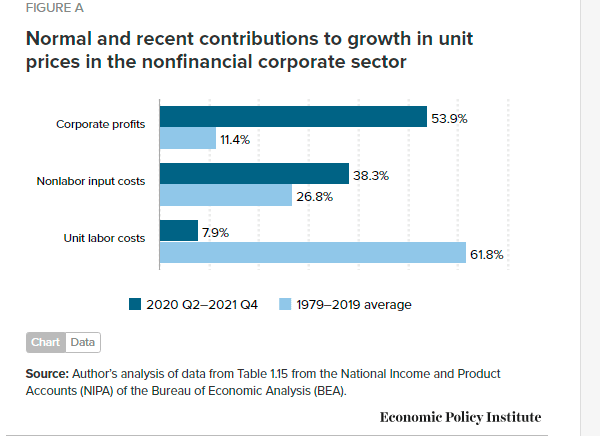

The Economic Policy Institute reckons that, since the trough of the COVID-19 recession in the second quarter of 2020, overall prices in the producing sector of the US economy have risen at an annualised rate of 6.1%—a pronounced acceleration over the 1.8% price growth that characterized the pre-pandemic business cycle of 2007–2019. Over half of this increase (53.9%) can be attributed to fatter profit margins, with labour costs contributing less than 8% of this increase. This is not normal. From 1979 to 2019, profits only contributed about 11% to price growth and labour costs over 60%. Non labour inputs (raw materials and components) are also driving up prices more than usual in the current economic recovery.

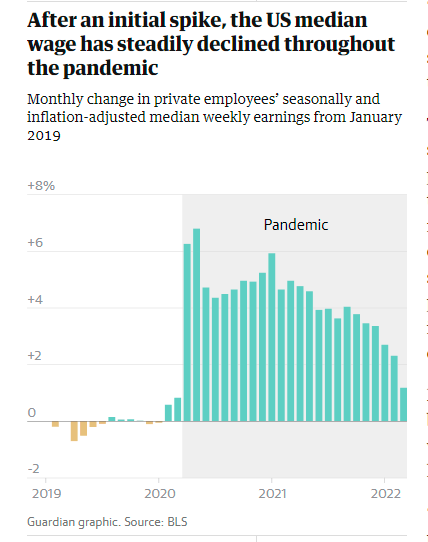

Current inflation is concentrated in the goods sector (particularly durable goods), driven by a collapse of supply chains in durable goods (with rolling port shutdowns around the world). The bottleneck is not labour asking for higher wages, shipping capacity and other non-labour shortages. Indeed, in the current inflation spike, US weekly earnings growth has been slowing month by month.

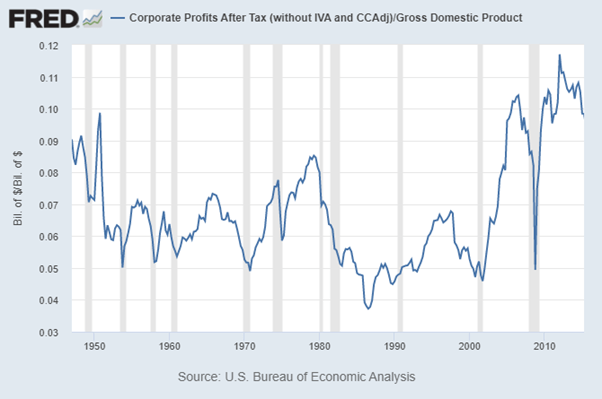

It’s profits that have been spiralling upwards. Firms that did happen to have supply on hand as the pandemic-driven demand surge hit have had enormous pricing power vis-à-vis their customers. Corporate profit margins (the share going to profits per unit of production) are at their highest since 1950.

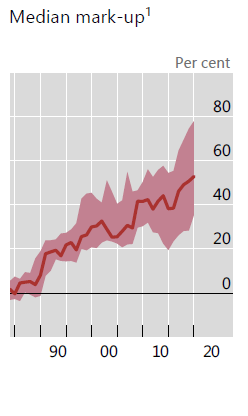

The BIS study finds similarly: “Firms’ pricing power, as measured by the markup of prices over costs, has increased to historical highs. In the low and stable inflation environment of the pre-pandemic era, higher markups lowered wage-price pass-through. But in a high inflation environment, higher markups could fuel inflation as businesses pay more attention to aggregate price growth and incorporate it into their pricing decisions. Indeed, this could be one reason why inflationary pressures have broadened recently in sectors that were not directly hit by bottlenecks.”

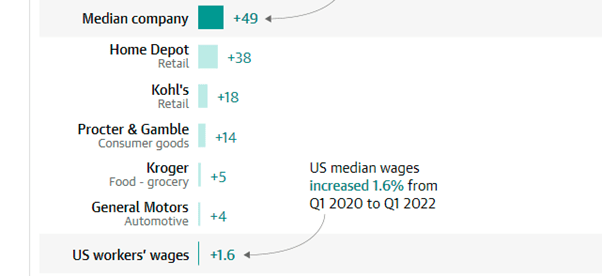

An analysis of the Securities and Exchange Commission filings for 100 US corporations found net profits up by a median of 49% in the last two years and in one case by as much as 111,000%!

Bosses see an opportunity to raise prices

Chief executives are acutely aware of the ability to hike prices in this inflationary spiral. Hershey bar CEO Michel Buck told shareholders: “Pricing will be an important lever for us this year and is expected to drive most of our growth.” Similarly, a Kroger executive told investors “a little bit of inflation is always good for our business”, while Hostess’s CEO in March said rising prices across the economy “helps” profits.

Does this mean that companies can raise prices at will and are engaged in what is called ‘price-gouging’? Marx, arguing with Weston in 1865, did not think that was the case in general. The power of competition still ruled. George Pearkes, an analyst at Bespoke Investment, pointed to Caterpillar, which recorded a 958% profit increase driven by volume growth and price realization between 2019 and 2021’s fourth quarters. Eliminating price increases may have dropped the company’s 2021 quarter four operating profits slightly below the $1.3bn it made in 2020. “This isn’t price gouging … and it shows pretty concretely that there’s a lot of nuance here,” Pearkes said, adding profiteering is “not the primary driver of inflation, nor the primary driver of corporate profits”.

Indeed, companies that push prices as hard as the current environment allows to maximise profits in the short run may find themselves paying a price in market share down the road as others get into the game. It is clear, however, that the higher the concentration of capital is in any sector, the greater the ability to hike prices. “When you go from 15 to 10 companies, not much changes,” one analyst argued. “When you go from 10 to six, a lot changes. But when you go from six to four – it’s a fix.”

Limits on the capacity to raise prices

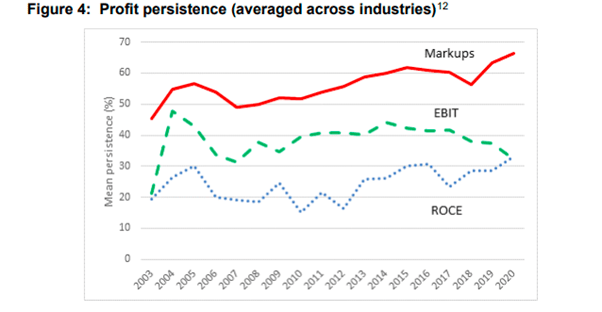

Recently, the UK’s Competitions and Market Authority (CMA) published an important report. The CMA found a mixed picture. Profit persistence has increased as measured by markups over marginal costs and the return on capital but not when measured by profits before tax.

And the CMA also found that the more international competition there was, the less ability for firms to increase prices and mark-ups. “This highlights the important role that international trade plays in contributing to keeping UK markets competitive.” The BIS summed up this debate: “In product markets, the degree of competition comes into play. Firms with higher markups – an indication of greater market power – could raise prices when wages increase, while those without such pricing power may hesitate to do so. Strategic considerations in price-setting are also relevant. Firms may feel more comfortable raising prices if they believe their competitors will also do so. Price increases are more likely when demand is strong. With less concern about losing sales and less room to adjust profit margins, even firms with less pricing power could pass higher costs through to customers.”

“Profit is the point of the whole exercise”!

As a partner in the Bain consultancy, an adviser to many corporations, argued, “when times are tough, screw your customers while the screwing is good!”. The consultant went on: “I don’t think this is actually nefarious at all. Companies should charge what they can. Profit is the point of the whole exercise.”

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.