By John Pickard

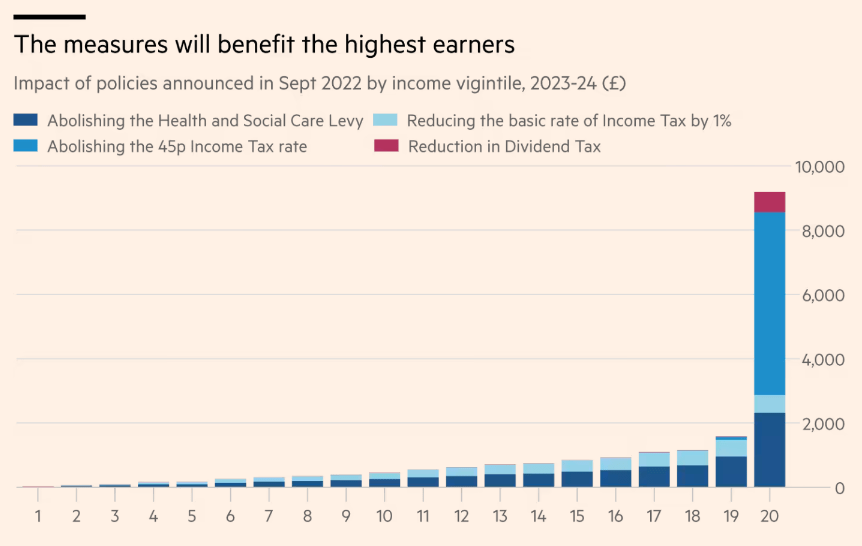

It is patently obvious to everyone that the mini-budget of new Chancellor, Kwasi Kwarteng, is a gigantic give away to the rich. According to some estimates, around half of the benefit from the tax give aways will accrue to the richest 1% of the population. It has created a furious reaction from trade unions, campaign groups and charities.

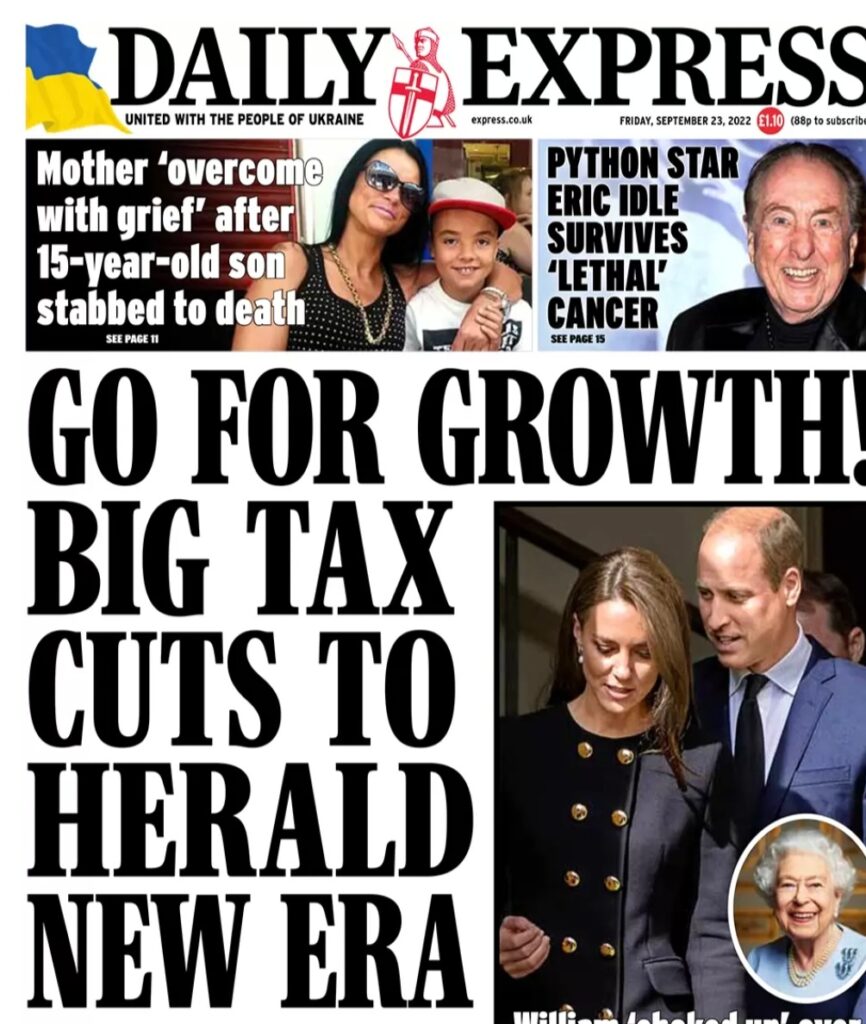

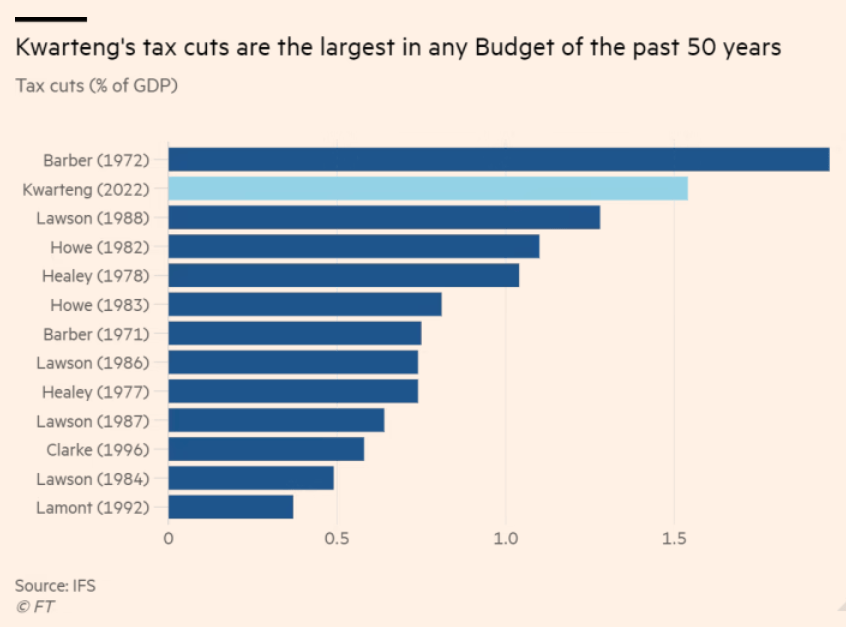

Kwarteng and Liz Truss have justified this inverse Robin Hood policy by claiming that it will drive the economy forward so that everyone will benefit. But a quick look at the reactions of the more serious commentators and economists shows an almost universal pessimism about the likely outcome from the biggest tax-give away for fifty years. Even from the standpoint of what is in the best interests of the capitalist class and the British economy, the budget is an unmitigated disaster.

As an article in the FT put it on September 23, “Economists are rarely united, but the vast majority agreed on Friday that Kwasi Kwarteng’s fiscal package was built on borrowing and hoping that things turn out for the best. They expected the new chancellor’s hopes to be dashed”.

Comments from most FT contributors were critical of Kwarteng

The Financial Times is a newspaper that defends all the principles of the market economy, but unlike propaganda rags like the Mail and the Express, it commentates in a sober and measured manner. On Friday evening after the Chancellor’s speech, almost all of the comments from its contributors were critical of Kwarteng’s tax reductions. The international markets – always a good indicator of the mood of investors and dealers – has given the budget a big thumbs down

The Financial Times 100 share index fell by nearly two percent on Friday afternoon after Kwarteng sat down in the House of Commons. Even more significantly, the pound fell against other currencies. Against the dollar, the pound fell to $1.09, its lowest for decades and against the Euro, it fell below €1.11 – whereas it had been €1.19 at the end of July.

It has been suggested that when the markets reopen on Monday morning that there will be further declines in share prices and the strength of Sterling. “There is a real risk” the chief investment officer said at one Asset Management company, “that international investors lose confidence in the UK government and that leads to a run on sterling.”

The decline against the dollar is particularly important because oil and other commodities are priced in dollars and the fall of the pound will be reflected in higher petrol and diesel prices and more expensive imports generally. It is therefore a budget that will increase rather than decrease inflation.

Massive subsidy to big energy companies

What particularly exercises capitalist economists is that the huge tax cuts, coupled with the £100bn subsidy to the big energy companies to keep prices down, is adding a mountainous burden the national debt…and this from a political party that has tried to build a reputation for ‘sound finance’, with government not spending more than it can afford.

No wonder, then, that even Tory MPs are feeling some disquiet over the budget. As Kwarteng was speaking to the House of Commons, it was without the usual cheering and huzzahs from the Tory back benches. Tory MPs have taken note of the fact that the Office for Budget Responsibility, the UK fiscal watchdog that usually publishes the expected economic impact of a budget have not done been allowed to do so on this occasion, on the grounds that Kwarteng’s measures were only a ‘mini-budget’.

“There is no doubt” the Financial Times article continued, “about the scale of additional borrowing required. Following the statement, the government’s Debt Management Office set out new plans to borrow an additional £72bn before next April, raising the financing remit in 2022-23 to £234bn”.

All of the new debt will have to be paid for by borrowing and international money markets will not cough up billions to buy UK government bonds at low interest rates. Interest rates, therefore, are heading north. The Bank of England has raised the base rate by 0.5% only a week ago and there is now a suggestion that there may be an emergency meeting of the BoE monetary committee to raise the rate again. Markets are betting on 5% rates by next year and higher rates mean government debt repayments are dearer and the National Debt, currently around £1tr balloons even more.

For mortgage holders, this is a disaster, as every single 1% rise in interest equates to an increase of £60 a month on the average mortgage. Not surprisingly, most economists believe that it will all end in tears.

Possibly a short-lived economic book – a ‘sugar rush’

Few economists think the measures will make any serious impact on economic growth, besides a (possible) short-lived inflationary boom. The director of the think-tank the Institute for Public Policy Research, suggested that Kwarteng’s tax cuts would create a “sugar rush of immediate growth”, whilst at the same time, they would “turbo-charge inequality…while leaving public services on an unsustainable footing”. More to the point, in terms of the overall economy, they would reduce the scope for investment “by vastly expanding government borrowing for no clear economic gain”.

The Financial Times also quoted a spokesperson for a city consultancy, who argued that there would be no sustained economic growth from the Kwarteng budget. “The biggest winners”, he said, ”…are high earners, whose expenditure is not that responsive to changes in their income”.

“The UK has been cutting personal and corporate taxes for more than a decade,” said another economist at the New Economics Foundation, think-tank. “…We already know how it ends: stagnant wages, collapsing public services and stalling life expectancy.”

Martin Wolf, the Financial Times chief economic columnist is broadly of the same opinion. He suggests that Kwasi Kwarteng might be right to say that the UK is now “at the beginning of a new era”. However, he adds “It is new in his willingness to pour scorn on the past 12 years of Tory rule. It is new in the size of his gamble with economic stability.”

“Reality always wins in the end”

“In sum”, Wolf writes, “this mini-Budget will do nigh on nothing to raise medium-term growth, but risks serious macroeconomic instability. The failure to ask the Office for Budget Responsibility to assess its impact is simply scandalous. This government may be indifferent to painful reality. But reality usually wins in the end”.

Painful reality indeed, and no more painful than it is for workers suffering the biggest cuts in living standards for decades. Little comfort unfortunately is coming from Labour’s front bench. Shadow Chancellor, Rachel Reeves, is correct to accuse the government of “shielding energy companies” who are making “excess profits”. Oil and gas producers, she said, “will be toasting the chancellor in the boardrooms as we speak, while working people will be left to pick up the bill.”

But beyond this, there is unfortunately no attempt – and nor will there be from this Labour leadership – to make any serious break with a system rigged in the interests of a tiny minority. We live in a capitalist system, its fortunes relying on the vicissitudes of the market day by day, but it is clear that even by the rules and standards of the system that Kwasi Kwarteng claims to uphold, his attempts to revive the UK economy will fail.

Socialists will continue to fight inside the labour movement, therefore, for a leadership and policies that offer a fundamental break and genuine revolutionary change to bring about a system ‘rigged’ in the interest of the big majority of the population – the working class. Socialist policies have to mean the public ownership and democratic control of all banks and financial institutions, big corporations, land, transport and all utilities.

The economy needs to be taken out of the hands of the ‘market’ and built instead on a democratic plan, using the skills, resources and national wealth for a green economic development. Such a socialist plan of production is needed just to maintain present living standards. Nothing less will do.