Rishi Sunak has told those with mortgage to ‘hold their nerve’ in the battle with inflation. It is an insult of monstrous proportions, coming from the wealthiest Prime Minister in British history, to imply that ‘nerve’ can pay any bills. It is not ‘nerve’ that people need, but an end to this millionaires’ government.

Last Thursday, the Bank of England raised the base rate for the thirteenth month in a row, to a level fifty times higher than it was two years ago. From 0.1%, the rate has now been lifted to 5%, with 6% not too far away in the future.

This new rate rise will have zero impact on the life of Rishi Sunak, but for those households with mortgages, particularly younger families, the effects of this policy are devastating, adding already to the mounting challenges of paying for energy and other domestic bills, just to get along.

The background to the rate rise is the continuing high level of inflation. The official rate for May was still 8.7%, above expectations and higher than it is in France (6%), Germany (6.3%), the EU average (7.1%) and the USA (2.7%). The biggest items of household spending, eating up a much higher proportion of the income in poorer households, are energy and food. Many families had to choose over winter between heating and eating. Although energy costs are declining on world markets, gas and electricity for households is still twice the level of two years ago. Food inflation in May was officially over 18 per cent.

Many fixed-term mortgages coming to an end.

Coming on top of all of this, the much higher costs of mortgages – and rents will follow – is a bitter blow. Fixed-rate mortgage deals are very common nowadays, but they are always time-limited. According to the Financial Times, this year alone 1.4mn households – half of them under 40-years old – will see their fixed rate mortgage deals expire, in which case their payments will be bumped up. By the end of 2024, that number rises to 2.4mn.

Every 1% rise in interest payments translates roughly to an extra £60 a month for the average mortgage, so the increases of the last year and a half are taking as much as £300 a month extra out of households that are already badly stretched. It means that the sudden rise in mortgage rates for many families will be as bad, or worse, than the sudden rise in energy prices.

It is true that there are some ‘safety nets’ in place to deal with mortgage holders who get into financial difficulties, but it is little consolation to young families to have the life of a mortgage extended or a payment ‘holiday’, when it just means that more will have to be paid in the longer run. Whatever arrangements may be put in place, for a household in difficulties, it will create a pall of gloom and insecurity.

The policy of the Tory government is clear – to tackle inflation by taking money ‘out of circulation’, which means taking it out of people’s pockets. The Institute for Fiscal Studies think-tank, as a Financial Times report pointed out, “said interest rate increases over the past year were already on track to absorb 8.3 per cent of mortgage holders’ disposable income — a figure that rises to 20 per cent for 1.4mn people”. It is not so much that mortgages are a ‘ticking time bomb’ as some newspapers have suggested. The ‘bomb’ has already gone off.

Bigger impact than energy price rise…Guardian:

As mortgages go up, so rents will follow. “Annual rental prices in the UK” the Financial Times reported, “rose 5 per cent in May, the highest rate for seven years…” (June 21). For hundreds of thousands of young couples particularly, housing is getting further and further out of reach. They cannot afford to buy or rent.

In any sane society, every effort would be made to build more, to really combat the shortage of decent houses and to provide affordable homes for the population. But because of the way the housing ‘market’ works, the threat of a fall in the price of houses – predicted now to fall by anything up to 10% – developers and the big building companies will be aiming to build fewer, not more homes, to keep prices and rents up.

It is not as if there isn’t a huge amount of money sloshing around in the banks and in the accounts of big businesses. As articles have pointed out, the energy giants have profiteered massively from the crushing of living standards. Writing in the Guardian, former Shadow Chancellor, John McDonnell pointed out that the five biggest UK banks, Barclays, HSBC, Lloyds, NatWest and Standard Chartered, “posted profits of around £37bn for 2022”.

“An analysis by the Unite union in May found that UK banks made an extra £7bn by refusing to pass on higher interest rates to savers. In April 2023, many of those banks were paying customers rates of less than 1.3% on their easy-access savings accounts, despite the Bank of England base rate being 4.25%”.

An earlier and very detailed analysis by the union, Unite, accused British companies right across different sectors, of “systematic profiteering” during the cost of living crisis.

Starmer and Reeves’ appalling abdication of leadership

Unfortunately, the response of the Keir Starmer/Rachel Reeves leadership to the hike in mortgages has been disgraceful, offering little comfort to mortgage-holders who might find themselves in distress. They appeal, for example, for banks and building societies, to “wait six months” before initiating repossession processes. What their five-point plan amounts to is an appeal to banks and mortgage lenders to be ‘nice’ to those families with economic problems. It is in reality an appalling abdication of any real leadership from senior Labour figures.

John McDonnell has at least argued in the Guardian for policies that target the vested economic interests of the banks and lenders:

“The banks”, he argued, “could voluntarily shoulder some of the burden of the rise in interest rates and take a form of haircut”. If the banks are not willing to act, he goes on, “the government should intervene and levy an excess profits tax on the sector. If the UK’s big five banks were required to pay a windfall tax of 15% (equivalent to Nationwide’s customer payout), it could fund a mortgage interest relief scheme of £5.5bn for 2022, and likely significantly higher in 2023. A 15% tax on Q1 2023 profits alone would be £3bn”.

This is all very well, but the idea that this government, of all governments, would act against the vested interests and profits of big financial institutions is a ludicrous idea. What is required is not appeals to the government, or the better nature of bankers. It is a mass campaign to get rid of this government. John McDonnell should be appealing to the trade union movement in particular to use its enormous resources and influence to mobilise support to get the Tories out.

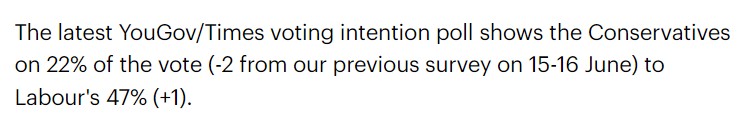

The cost of living crisis and the double whammy of energy price rises and mortgage hikes has obvious implications for the future of this government and the outcome of the next general election. As the latest opinion polls show, the Labour Party is even further ahead of the Tories – and this is not in the slightest down to the leadership of Starmer. But for most people, an election can’t come soon enough.

Urgent economic times demand urgent economic measures

There are two tasks that the trade union leadership and left MPs ought to be addressing in earnest. The first is to mobilise a campaign among working people against the government. No-one can afford to wait another eighteen months for a general election.

But the second is just as important. Urgent economic times demand urgent economic responses. The left in the Labour Party – and, despite the pessimism of the social media bubble, it has not disappeared – needs to redouble their fight for socialist policies to answer the crisis in living standards.

Banks and finance houses need to be publicly owned companies, run democratically for the benefit of the population, and able to provide affordable financing to families to buy homes and for local authorities to build council housing. Development land and the big building companies need to be brought under state and local authority ownership so that resources can be planned to build good, affordable homes enough for all.

The starting point of a socialist policy on housing is that the right to a decent, affordable home is a human right, and the Labour Party should treat it as such. If that means challenging the vested interests of rent, interest and profit, then so be it; that is the historic goal of the labour movement. If ‘nerve’ is needed in times of economic crisis, it is nerve to pursue to the end what is the only viable policy that can offer decent homes to all.