By Michael Roberts

In the second quarter of this year, the UK economy grew by a ‘staggering’ 0.2% in real GDP. The media and government were in raptures that the expected recession in the UK was being avoided. Indeed, real GDP is up 0.4% from the same period in 2022.

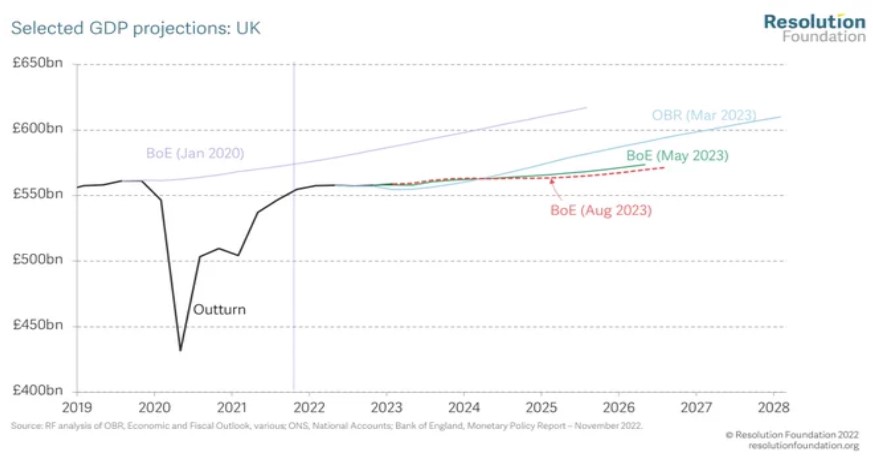

So all is well. But no. First, while a ‘technical’ recession (two consecutive quarters of contraction in real GDP) is no longer forecast for 2023, the Bank of England still expects stagnant output for next two years! And that may be the best outcome. The BoE Governor Andrew Bailey said, “We hope we can deliver the path we expect with no recession, but we will have to see”.

As the economic think-tank, the Resolution Foundation put it: “this might not be a technical recession but we are experiencing the weakest growth for 65 years outside of one (a recession).”

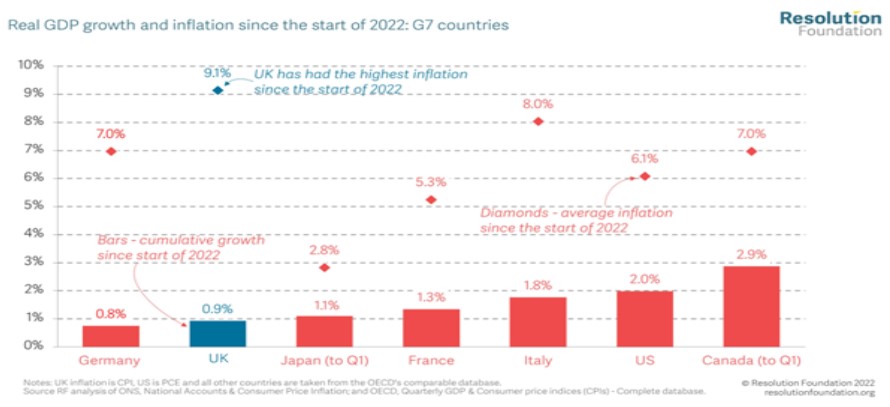

And the UK economy is just falling behind. Compared to the rest of the G7 economies, the UK has the highest inflation rate and the second lowest GDP growth (just in front of Germany which went into recession this year).

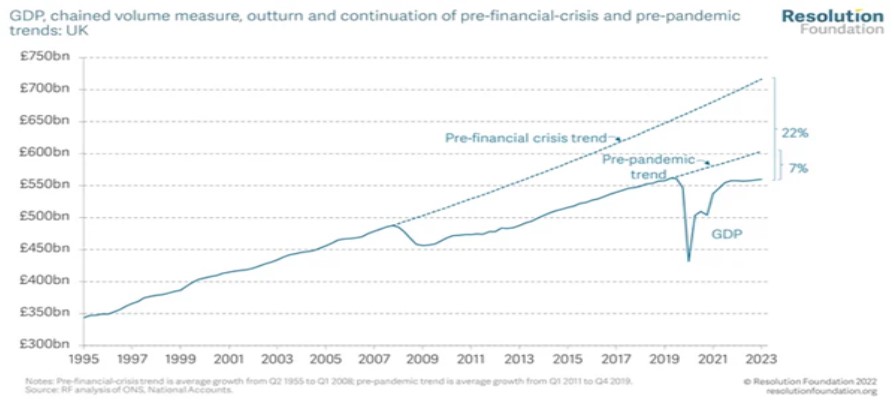

Real GDP growth is still more than 20% below its pre 2008 trend – although that fallback applies to all G7 economies, if at lesser rate.

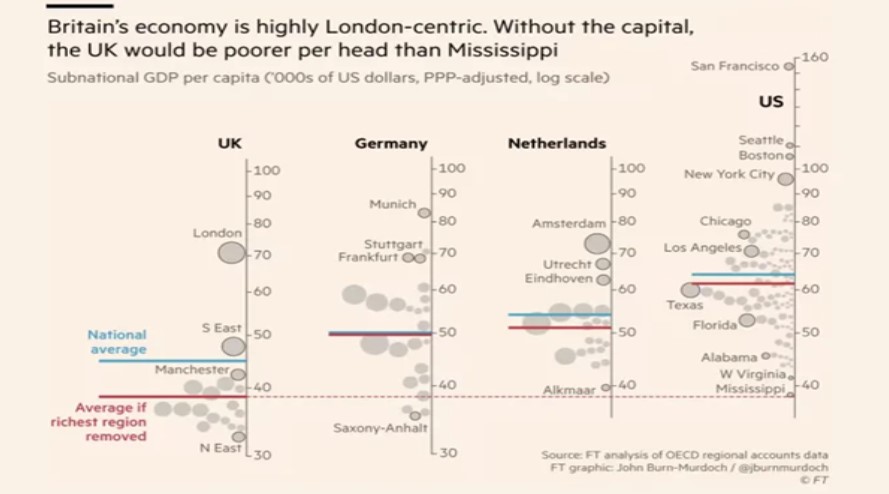

And there is the staggering fact that without London in the equation for real output per person, the UK average would be below that of the poorest state in the US – Mississippi! (Financial Times, August 11)

Indeed, people in north-east of England have an average standard of living less than half that of the average Londoner. There is no greater regional disparity anywhere else in Europe or the US. So much for ‘levelling up’.

From the blog of Michael Roberts. The original can be found here.