By John Pickard

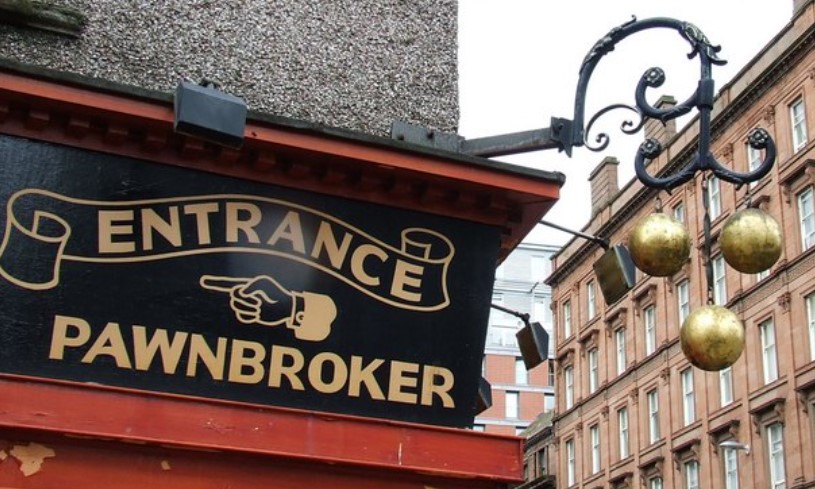

For working class families in the past, the pawnbroker was the equivalent of the pay-day money-lender, except on more favourable terms. The local pawnbroker was usually fronted as a second-hand shop or a jewellers, but because of the stigma, the pawnbroking business was conducted around the back.

Working class people – and it was nearly always the women – would take an item to ‘uncle’, as the expression was, to barter for a loan using it as collateral or a ‘pledge’. It might be something like a Sunday suit, or family jewellery, or something else with no immediate use. The stigma meant that you didn’t want to see anyone you know there and in the dimly-lit back of the shop there were ‘boothes’ so each customer was screened off from their neighbour with a wooden partition.

Once you had your money in hand, you would take it away with the ticket you were given. You needed the ticket to redeem your goods on pay day, with a small additional sum in interest. If for any reason you didn’t redeem the goods in a certain time, you lost them, and they ended up in the front window of the shop as second-hand goods for sale.

Pawn shops used to be part and parcel of working class life in the past, but they fell out of use from the sixties onwards. The sign of the ‘three balls’ is still to be seen in some old High Streets, often over a jeweller’s shop. But expressions like ‘uncle’ or ‘popping’ your goods, all but disappeared, except for the odd appearance in a cryptic crossword clue.

Tories taking us back a couple of generations

Most young people today have never heard of pawn shops. I once told my kids, “there used to be a pawn shop here”. But all they heard, to their surprise, was that I used to know where there was a “porn shop”.

Now, as a sure sign that the Tories are taking us back a couple of generations, we read in the Financial Times (August 13), that the demand for pawnbroking is reaching record levels again. The head of the UK’s biggest pawnbroker, the H&T Group, told the FT the “pre-tax profit rose 31 per cent to £8.8mn in the first half of the year compared with 2022”. The company pointed out that its “pledge book” – the total value of its ‘pledges held against loans – was “worth £114.6mn in June, up from £85.1mn in the same month last year”.

So many families now are living from hand to mouth that there are few alternatives for loans to support households waiting for payday. It is impossible to get bank loan, without a lot of paperwork – and anyway, poorer families are most likely ineligible – and loan sharks are an expensive and possibly dangerous alternative. As H&T Group chief executive put it, “If you only want and need to borrow £200, your options are very limited.”

The few pawnbrokers that have survived over the years are now benefitting from the lack of competition. Another pawnbroker, Ramsdens, saw its pre-tax profit in the six months to March rise by 68 per cent to £3.7mn on a 33 per cent rise in revenue. Its loan book rose 29 per cent to £9.7mn over the same period, while net assets increased by £5.4mn to £43mn.

Too many working class families too often strapped for cash

“There is a lack of small-sum, short-term credit,” its chief executive told the FT. “Home collected credit has been decimated, payday lending has been decimated — so the customer has fewer options.”

All of those interviewed by the FT have acknowledged that the rising cost of living and the inability of households to pay their bills are the drivers of the extra business. “It’s clear that bills are higher,” the chief executive of Ramsden’s told the FT, “because we see that with our median loan increasing from £150 to £170.”

For working class families who are strapped for cash – and there are growing numbers in that category – pawnbrokers are the only option. Their rates of interest are higher than rates for bank loans, but much less that loan sharks and payday lenders.

A typical pawnbroker charges the equivalent of around 155% APR, although most loans are very short term – that contrasts the the APR that was charged by Wonga, for example (now collapsed) which was 5,000%

Pawnbroking largely disappeared decades ago because living stardards by and large increased year on year. Today, society is in regression. Pawnbroking is like a small sticking plaster on a wound. Only the wound – relentless cuts in living standards – is not healing, but getting worse with each passing month.

The resurgence of a ‘profession’ that had been in decline for two generations shows once again that the new poor aren’t the unemployed, but largely the working poor. For a week’s work, workers are just not being paid enough to live on, and that is a situation that cannot be sustained forever.