By Michael Roberts

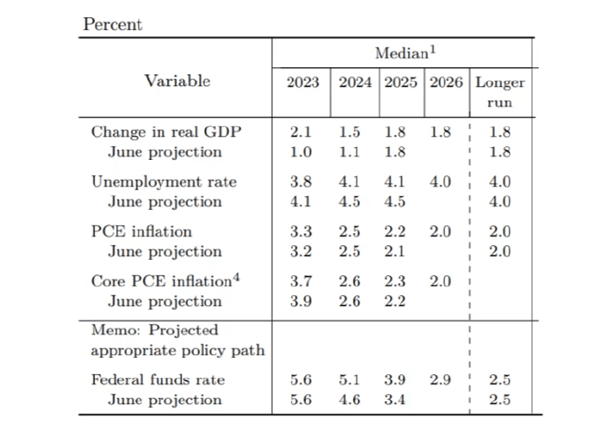

This month the European Central Bank again hiked its policy interest rate, the rate that provides the floor to all credit rates in finance, industry and for households. Last week the US Federal Reserve decided to ‘pause’, although the ‘projections’ by members of the Fed’ monetary policy committee (FOMC) show that they expect to raise the Fed rate higher and for longer than previously forecast. The Bank of England also ‘paused’, but only by a narrow vote 5-4 to do so.

The ostensible aim of the Fed and the other major banks is to reduce ‘excessive demand’ in the economy i.e. ‘excessive’ spending by households, businesses (and governments), by raising the cost of borrowing across the board. They claim that the labour market is too strong, wages are rising too much and (now it is even admitted) that profits have risen too much.

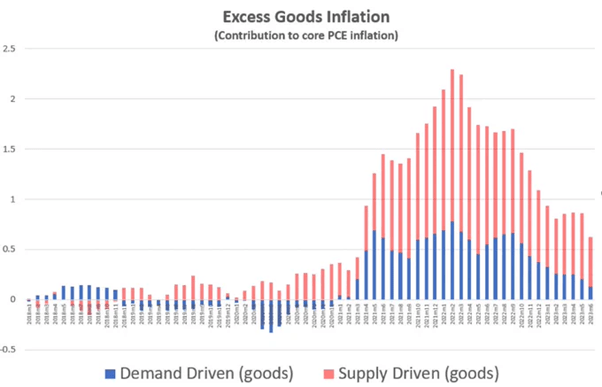

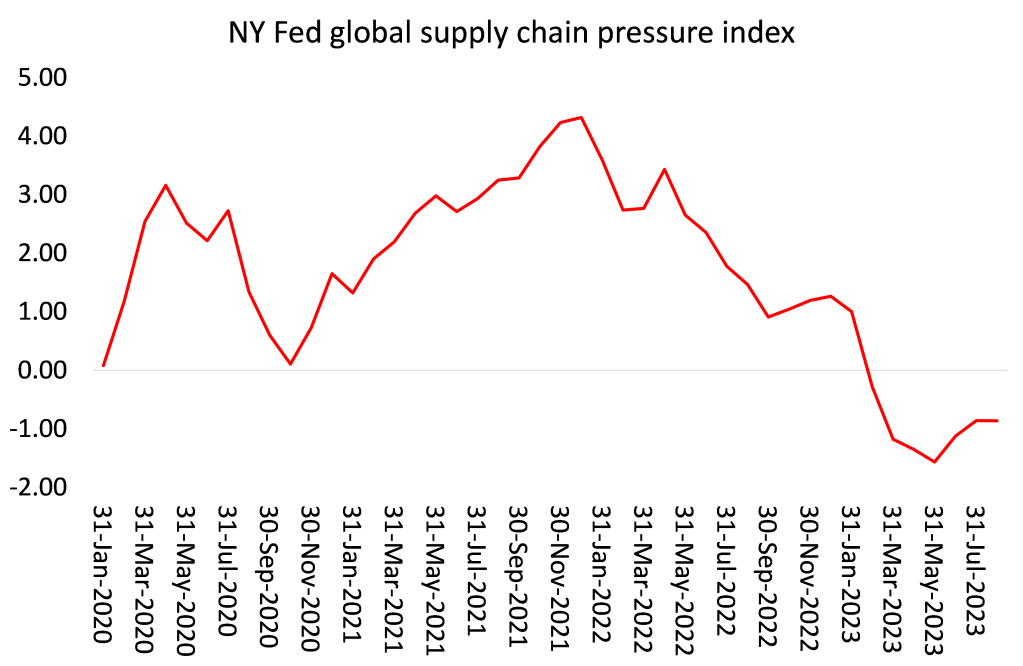

Recent price inflation caused by global supply ‘blockages’

Central bank leaders parrot this claim even though it has been abundantly demonstrated in now numerous studies that the recent price inflation spiral was caused not by ‘excessive demand’, but by insufficient supply, in particular global supply ‘blockages’ for food, energy and other raw materials and components that initially drove up prices and spread across all sectors.

The UK’s Financial Times summed it up: “Those who looked prescient in predicting how high inflation would rise in 2021 and 2022 — mostly economists focused on excess demand — almost universally failed to predict the rapid decline in inflation, accompanied by economic strength, that we have seen in the past 12 months. Economists whose theoretical apparatus explains the last year nicely —mostly those focused on the coronavirus pandemic supply shock — look wise now.”

Indeed, it is clear that the fall in ‘headline’ inflation in most economies over the last year is because energy and food price inflation has abated and even fallen back. As mainstream economist Alan Blinder put it in the Wall Street Journal: “That headline inflation has dropped more than core inflation tells you that lower food or energy inflation played a meaningful role…. Was the rest of the stunning drop in inflation in 2022 due to the Fed’s interest-rate policy? Driving inflation down was certainly the central bank’s intent. But it defies credulity to think that interest-rate hikes that started only in March could have cut inflation appreciably by July. There is an argument that monetary policy works faster now than it used to—but not that fast. What did change dramatically was the supply bottlenecks. Major contributors to inflation in 2021 and the first half of 2022, they are now mostly behind us.”

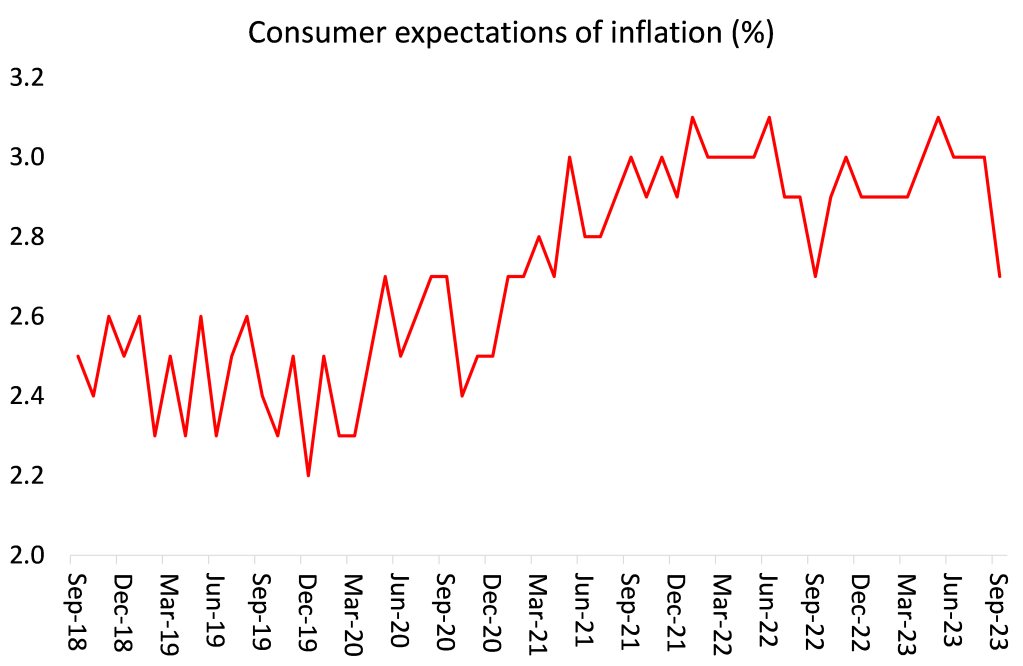

So the fall in inflation has had little to do with central bank action – although the central banks also claim that hiking rates keeps inflation ‘expectations’ down and this can be a driver of rising inflation. Again, the evidence for reckoning that inflation is caused by ‘expectations’ of rising inflation is weak. Expectation measures over the last two years show no such jump up, rising from about 2% a year before the pandemic to just 3% at the peak of the inflationary spiral, and now falling back.

But it’s true that it takes two to tango. Market prices tend to stabilise when supply equals demand. This is mainstream neoclassical theory – at the level of appearance. In reality, both factors are moving continually. Over the longer term, prices will tend to be driven by the growth of value in production and productivity ie the time taken to produce a commodity for sale; and then in the relation to money supply growth. But short-term factors can affect the balance of supply and demand – as the COVID pandemic did.

Think of it this way. Say, Aggregate Demand = 100 and Aggregate Supply = 100, then Prices will be steady. Now if Supply drops to 90 and Demand is unchanged at 100, then Prices will tend to rise. This was the situation after the pandemic due to the supply-side blockages and poor productivity growth. The central bankers claimed that demand was too high compared to supply – and on the face of it, they were right. Their answer was to drive down demand towards 90. But then if the balance between supply and demand went down to 90, this would be a much lower level of economic activity – in effect a slump compared to the previous 100. So central banks are only effective in reducing inflation caused by supply-side factors by helping to sustain or cause a slump. Luckily for the central bankers, the supply side has recovered somewhat, at least in energy, food and components. Say, it has now risen back to 95. So the inflation rate has slowed, although still higher than before and with economic activity still weaker than before.

What are the prospects for a recession?

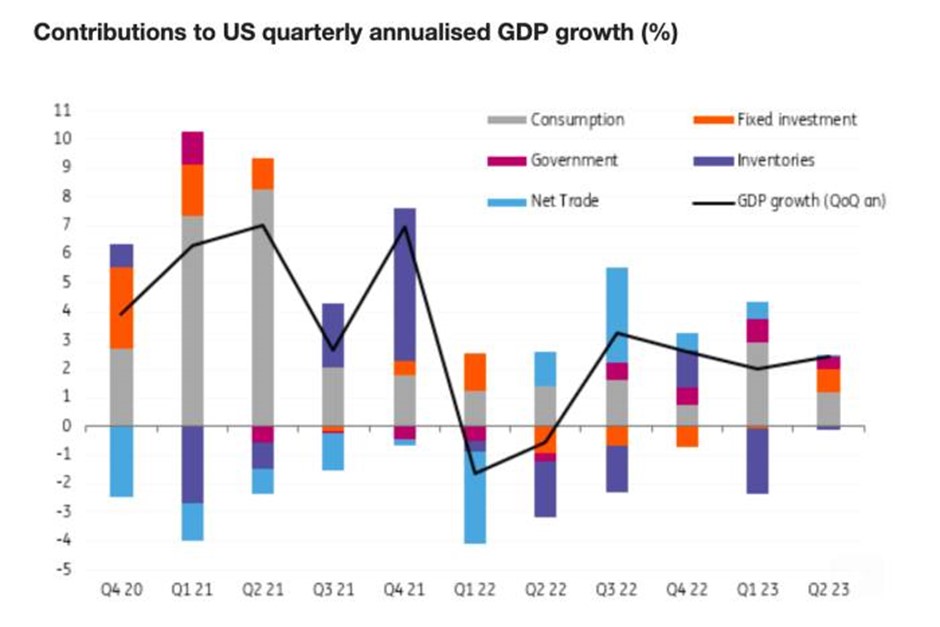

That’s where we are now in the major economies. What next? Is a recession in the next six months still likely? Well, as measured by GDP, the US economy up to now has still been growing, if at a modest pace.

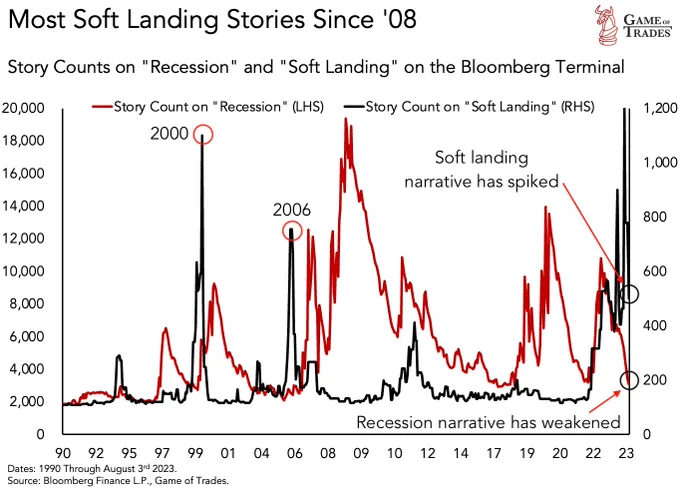

Forecasts for the current quarter ending this week suggest a further expansion of between 2-4% ‘annualised’ growth, so perhaps even better than in Q2. And now the consensus view among mainstream economists is that the US economy at least is heading for a ‘soft landing’ (missing recession), or even no landing at all.

Indeed, even Fed chair Powell is warming to this consensus. At the Fed’s press conference, Powell commented: “I’ve always thought that the soft landing was a plausible outcome, that there was a path, really, to a soft landing. I have thought that and I’ve said that since we lifted off” but then he added that “ultimately this may be decided by factors that are outside of our control at the end of the day, but I do think it’s possible”. Indeed, if the US economy does have a ‘soft landing’, it will not be due to anything that the Fed does. Instead, it will depend on how the key sectors of the economy are doing with productivity, investment and profits.

US employment figures

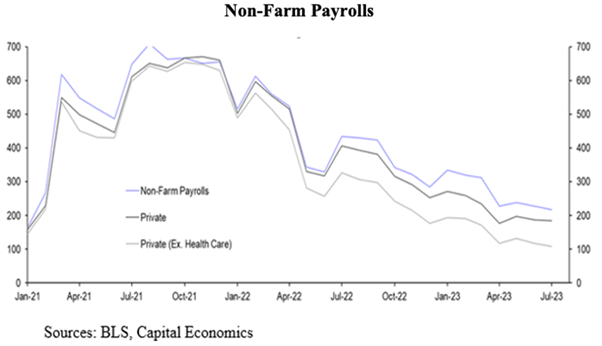

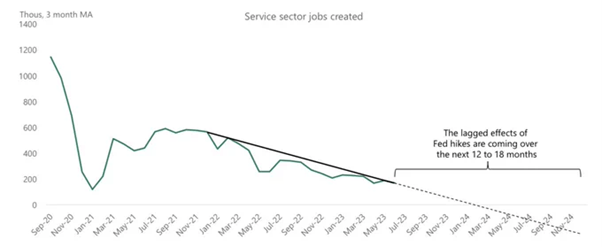

Just two months ago, I reckoned that the Goldilocks scenario of a not too hot (inflationary), not too cold (recession) outcome for the US economy was not likely. Yes, unemployment rates have stayed near all-time lows, although the FOMC’s projections do recognize a modest rise over the next two years. But the official rate does not reveal the full story. Most jobs created in the last year have been part-time. Indeed, there has been a decline of 311k full-time jobs since April. And job creation growth is fading fast.

And the official figures for employment were recently adjusted. And the seasonally adjusted figure for jobs for the last month showed a modest rise of 187k jobs, but unadjusted jobs fell 817k. And jobs data have had negative revisions for the last seven months in a row. And it is not just declining new jobs in the goods sectors, but also in services, which had been booming.

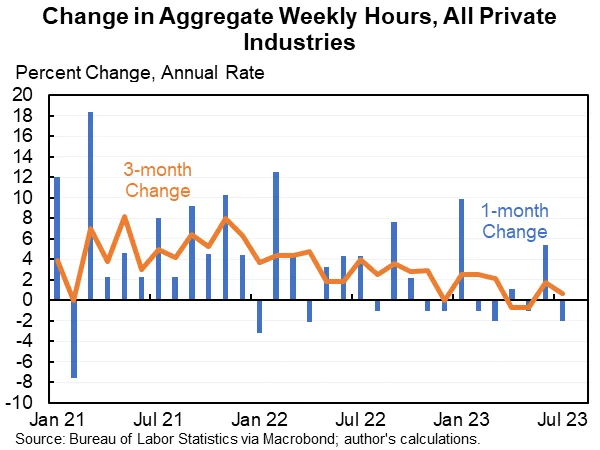

Moreover, hours worked in industry have been dropping back. So fewer new jobs and fewer hours being worked.

Household savings going down and personal credit defaults going up

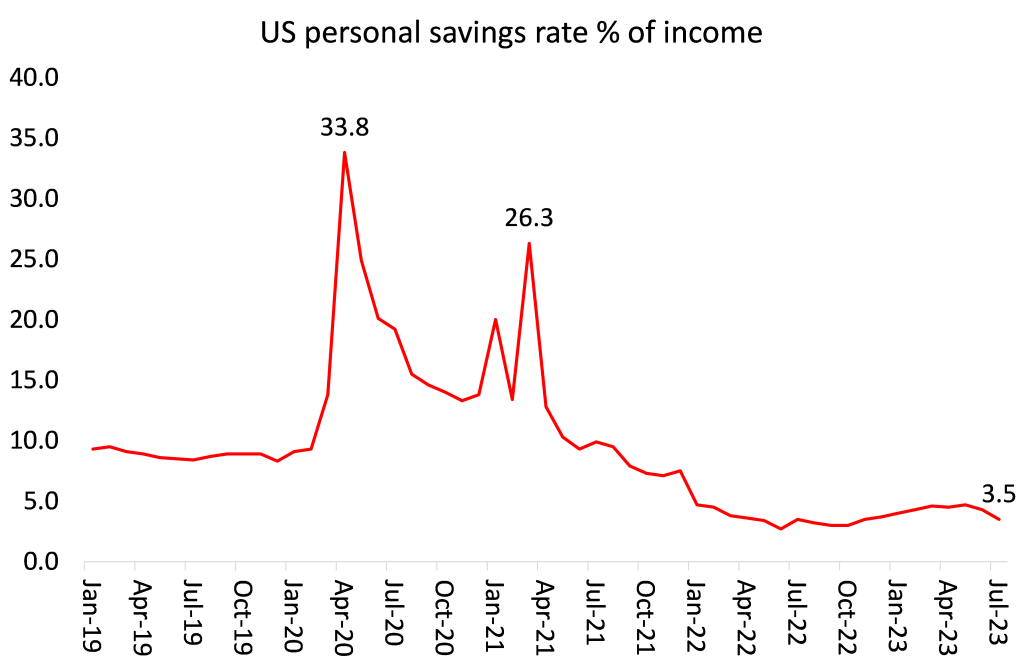

Going back to our example above, aggregate demand is heading south anyway, whatever the Fed does. Household savings rates, which were very high during and after the pandemic, have slumped.

Increasingly, average American households must rely on incomes from work but inflation has eaten away purchasing power; or on borrowing (credit cards and loans on big ticket items like cars). Americans’ inflation-adjusted median household income fell to $74,580 in 2022, declining 2.3% from the 2021 estimate of $76,330. The amount has dropped 4.7% since its peak in 2019. There has been some recovery in 2023 as price inflation fell below wage rises, but by end 2023, average household real incomes will still be below that of 2019.

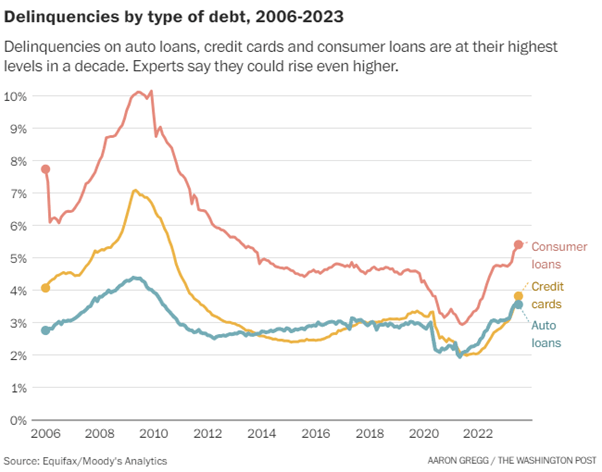

As a result, delinquencies on auto loans, credit cards and consumer loans have hit their highest levels since 2012. People are “fighting” inflation with debt they can’t afford.

Corporate profits, productivity and bankruptcies

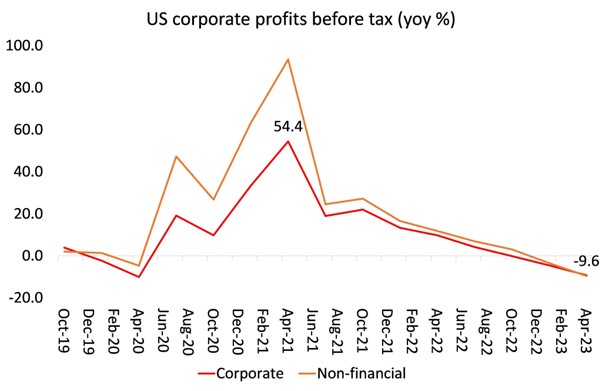

As for the business sector, after recording record profits during and immediately after the pandemic, corporate profits have turned down as productivity growth disappeared, wages rose and interest rates on borrowing increased. In Q2 2023, corporate profits dropped by nearly 10% compared to Q2 2022. And as this blog often argues, profits are the lead indicator for productive investment (which usually lags by a year, followed by falling employment and consumption).

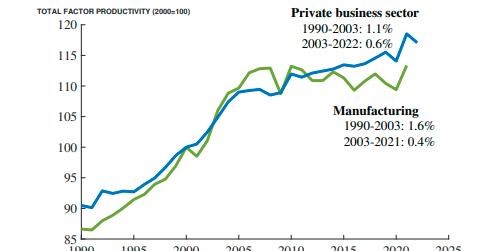

Productivity in manufacturing has ground to a halt and slowed sharply across the economy.

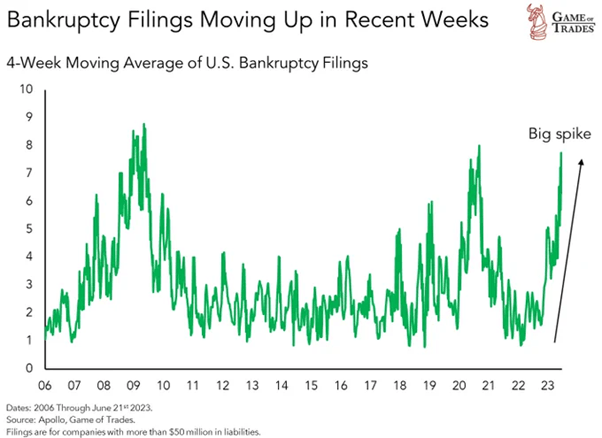

Rising costs of borrowing and falling profits are driving the weaker sections of business into bankruptcy.

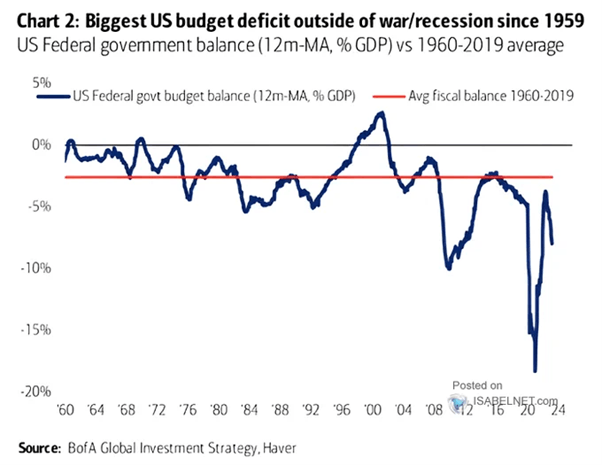

Government spending is the smallest component of demand. Even so, the largesse handed out during the COVID pandemic certainly helped to ameliorate income losses then. But the COVID handouts are over and the moratorium on student loan payments ends next month. After recording the largest federal budget deficit since the Korean war, fiscal spending is now being tightened (except in arms and defence, of course).

Stresses on the banking sector rumbling beneath the surface

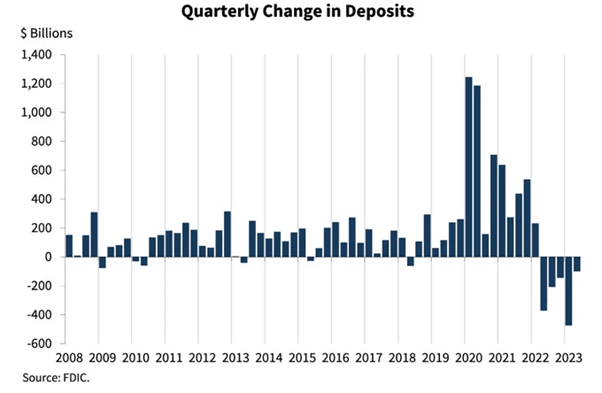

Then there is the banking crisis that exploded last March with the collapse of several small banks from a classic run on deposits. These banks were bailed out by special credit facilities from the Fed and by public funds through the Federal Deposit Insurance Corporation (FDIC). The immediate crisis subsided but it is still rumbling beneath the surface. Customer deposits are continuing to flow out of the small banks into the large ones and/or into money market funds.

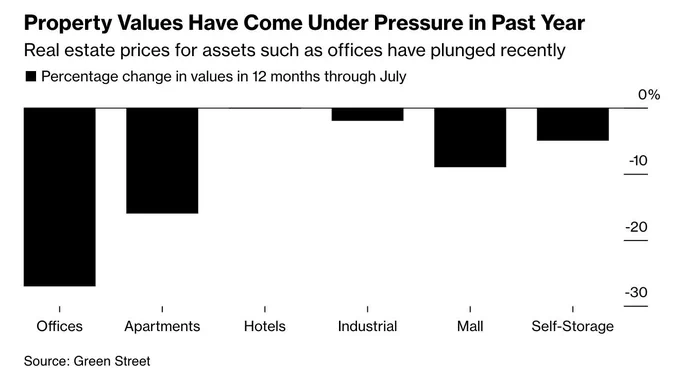

Usage of the Fed’s emergency bank funding facility now stands at a new record high of $108 billion, even as the regional bank crisis is “over.” The banks are paying the Fed 5.5% interest on these loans. On the other side of the banks’ balance sheet are the loans they have made to commercial real estate (CRE) developers (similar to the mess in China). Small banks now hold $1.9trn in CRE. But real estate prices are down 20% and over $1.5trn of these loans are due to renewed by 2025 with interest rates more than doubled.

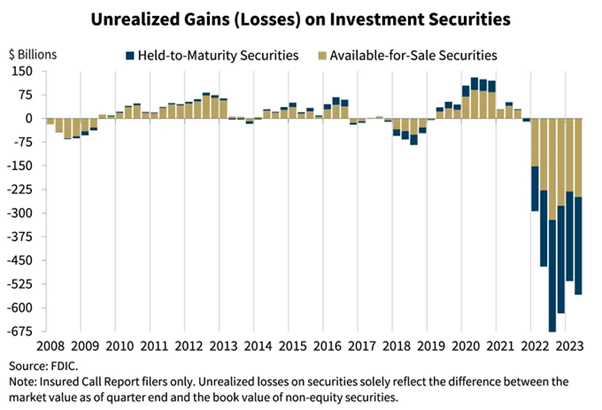

And the banks have invested heavily in government securities, but the prices of these bonds have plummeted as the Fed hiked interest rates. It was the potential (and realized) losses on these securities that brought down those banks last March. This problem has not gone away. Unrealized securities losses now stand at $558 billion and are rising again.

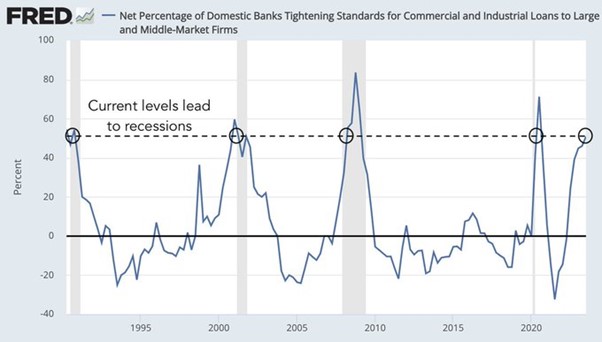

Given their situation, banks are increasingly unwilling to lend, so that many small (and larger) companies face meltdown.

Latest forecasts for the US economy

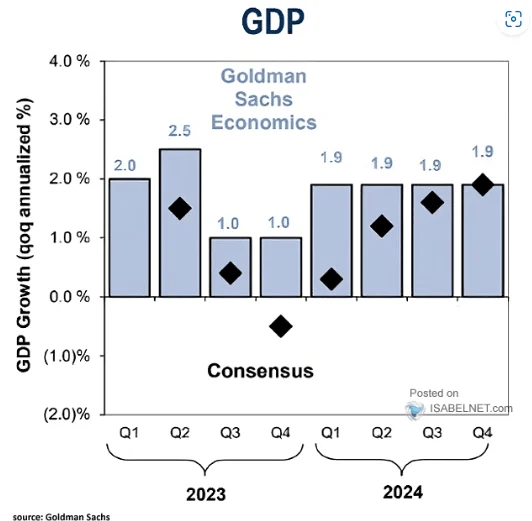

All this adds up to a story that is not quite so rosy as the consensus believes. Indeed, even if the US records some real GDP growth in the Q3 ending now, the normally very optimistic Goldman Sachs still sees a contraction coming in the last quarter of 2023, before a modest recovery in 2024.

The Fed’s own forecast for US economic growth this year has now been raised to 2.1%, with unemployment only ticking up slightly – the soft landing.

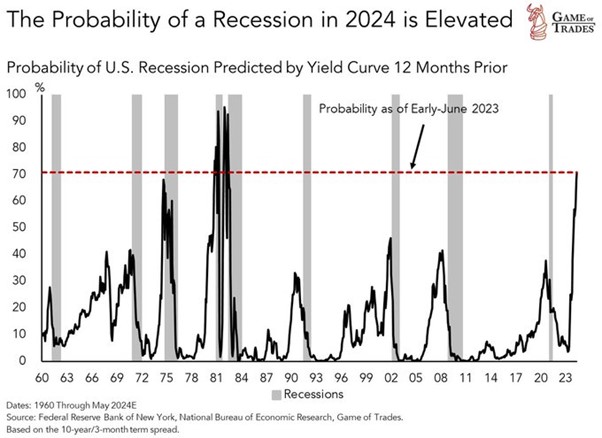

But indexes that look at all the factors in the economy still suggest a high probability of a recession eg the New York Fed model below.

Economic prospects worse elsewhere in the world

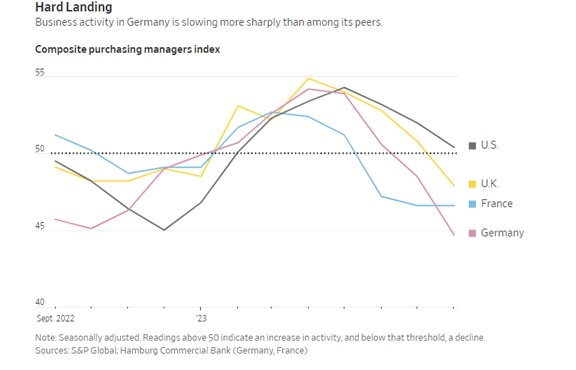

And remember the ‘soft landing’ is for the US only. The US is the best-performing major economy at a Fed forecast 2% growth rate, slowing to 1.5% next year. Elsewhere, the rest of the G7 economies are either already in recession (Germany, Canada), or close to it (France, the UK, Japan). And several smaller European economies are contracting: Sweden, Netherlands and Austria, with eastern Europe also heading down. Most of the so-called Global South is in trouble.

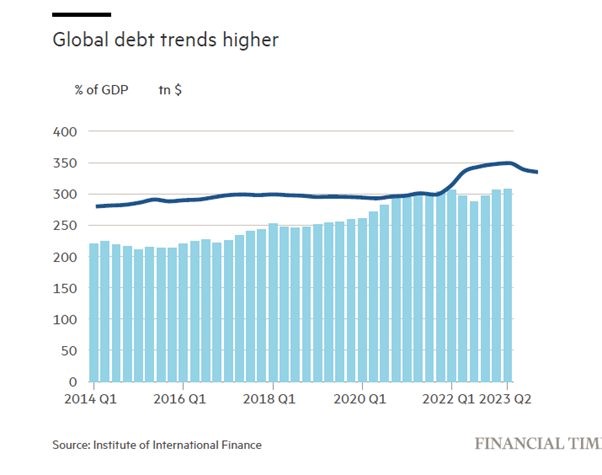

The IMF, World Bank and the OECD have all lowered their growth forecasts for this year and next – hardly an endorsement of a ‘soft landing’ globally. Global debt levels are now at a record high, while interest rates on that debt soar.

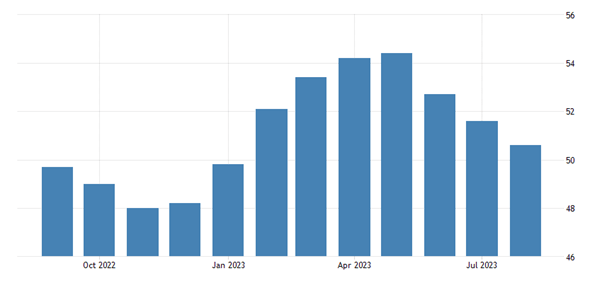

At the same time, economic activity globally (including China, India etc) is teetering on the cusp of contraction (50 is the threshold below).

The consensus may be for a soft landing in the US, but globally that is not so.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.

Featured image of a hot air balloon landed on snow by Eddy Schmakeit from Pixabay