By Michael Roberts

Within the huge ASSA meeting, there are sessions organized by heterodox economics associations, in particular, by the Union of Radical Political Economics (URPE). Attendance at these sessions is small, but the quality of the papers is large.

Let me start with the annual David Gordon lecture hosted by URPE at ASSA every year. Each year, a leading radical economist gives a lecture on a subject of choice. This year, David McNally gave the 25th lecture on Marx on Colonization: The End of Capital and the Beginning of a Journey. David McNally has contributed a Marxist perspective on many important global issues. Authoring over 60 research manuscripts, seven books, and countless public lectures and articles, he currently holds the Cullen Distinguished Professorship of History & Business at the University of Houston, having recently moved from Toronto, where he taught and organized at York University for over 30 years.

Economic development in the capitalist core and the periphery

His lecture was based around his latest book, Blood and Money: War, Slavery, Finance, and Empire. He argued that part of Marx’s theory on the rise of capitalism was founded on the concept of ‘primitive accumulation’, as outlined in the very last chapter of Marx’s Capital Volume One. Marx’s concept centred around the violent dispossession of direct producers from their land, forcing them to become wage labourers. But McNally argues that primitive accumulation did not just take place in Europe but also in the so-called colonial world. Here it took the form of the slave trade and bonded labour and engendered the racist nature of modern capitalism now. So capitalism in the core imperialist countries was built not just on the enclosures in Europe but also on the trade and exploitation of the bodies of those were forced into slavery in Africa, Asia and Latin America.

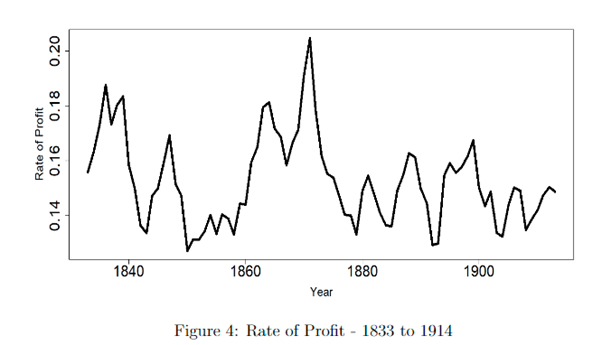

Staying with the relation between the imperialist core and the periphery, in another session, Kabeer Bora of the University of Utah investigated how surplus value extraction from India to the UK in the 19th century provided a significant boost to the UK’s profitability of capital as a counterfactor to the decline in domestic profitability. Bora estimates that from this ‘colonial drain’, every 1% increase in the extraction of profit and revenue from India raised the rate of profit in Britain by around 9 percentage points. Bora’s estimate of the UK rate of profit is similar to my own estimate for the 19th century, although he does not appear to have seen my work on this.

In the end, of course, the UK rate of profit on capital still fell during the long depression of the 1870s onwards and stayed low, as the UK hegemony declined.

The effect of imperialist domination

In another paper Emiliano Lopez and Deborah Noguera from Brazil took a look at how economic growth was damaged in peripheral economies by imperialist domination. Lopez and Noguera approached this from a post-Keynesian perspective which made it difficult to follow, in my opinion. They concluded that low wages and high inequality of incomes in the periphery were damaging to aggregate demand growth, while the dominance of the imperialist core in trade and investment held back the ability of the periphery to grow.

More to my liking was the excellent analysis of Carlos Duque from the Autonomous Metropolitan University in Mexico on waves of profitability in Colombia, entitled Economic Cycles, Investment and Profits in Colombia, 1967-2019. Based on the cyclical deviations of real GDP, Duque identifies six cycles in Colombia. And Duque found evidence in favour of Marx’s hypothesis that both the rate of profit and the mass of profits determine investment; while on the contrary, no evidence was found that investment determines either the rate of profit or the mass of profits. This is yet another confirmation of Marx’s law of profitability; but more than that, it also supports the view that I and other Marxist scholars have argued, namely that it is profit that leads investment and not vice versa – as the Keynesians and post-Keynesians argue.

Staying in the periphery, Bin Li from the Chinese Academy of Social Sciences argued that, unlike capitalist economies which face regular fiscal crises ie high budget deficits and rising public debt that must be financed by measures of austerity, that did not apply to China with its “Marxist socialization of production.” China avoided fiscal crises and so could expand investment steadily to contribute to rapid economic growth.

Periodic crises in capitalism

Turning back to the major economies in the core, Jose Tapia of Drexel University presented the key points in his new book, Six crises of the world capitalist economy from the 1970s. I won’t go into detail on Tapia’s book because I intend to review it on my blog soon. Tapia argues that there have been six crises in the world economy in the past half century, where the accumulation of capital slows down, generating spikes in business failures and mass unemployment, as well as downturns in CO2 emissions. Using data from the World Bank, he argues that crises in capitalism are no longer just at the level of national economies but at the level of an integrated world capitalist economy. There is more to say on this must-read book.

Another paper on waves of crises under capitalism was presented by Thomas Lambert of the University of Louisville. Using the archaic concept of economic surplus developed by Paul Baran and Paul Sweezy (in opposition to Marx’s law of the tendency of the rate of profit to fall), Lambert attempts to explain the ‘stagnation’ of capitalism in the last decades. While I agree with Lambert that the theory of long waves has merit, against the views of many Marxist economists (including Tapia above), I would argue that looking at the Marxist rate of profit on capital would provide a better insight into long waves than Baran’s ‘excess surplus’ theory. Lambert entitles his paper on long waves as Is neo-fascism inevitable?, arguing that capitalist stagnation and its failure to solve the problems of poverty and the imposition of austerity policies is provoking the rise of neo-fascist movements.

One of the features of the stagnation of capitalism in the 21st century has been the rise of the so-called zombies, companies that do not make enough profit to cover even the existing debt servicing costs. Bruno Miller Theodosio of the University of Utah presented new empirical evidence on the size and nature of these zombies. He argues that there are asymmetries in the distribution of US profit rates, caused by firms surviving with negative profits on the one hand and highly profitable “superstar” firms on the other. He refers to market monopoly power affecting the nature of capitalist competition since the 1980s. But this seems in contradiction to his support for ‘real competition’ as the central regulating mechanism of capitalism and a turbulent and antagonistic description of an economy led by the profit motive – similar to Shaikh’s view of capitalism. Shaikh is strongly opposed to theories of state monopoly capitalism or monopoly market power.

Could artificial intelligence restore productivity?

Will this stagnation last? In the mainstream sessions at ASSA (see my previous post), AI is seen as a possible way for capitalism to restore productivity growth over the next decade. But as Owen Davis at the New School of Social Research argues in his presentation, that would only happen at the expense of labour’s bargaining power. He quotes the ‘managerial view’ “What I would really like is software that keeps track of every person and every robot on the floor and tells each of them what it should do next” (warehouse manager quoted in Mehta and Levy, 2020). Currently, 10-30% of US workers are using generative AI tools at work; more than 90% of software developers use AI assistance; one-quarter of HR professionals report using AI or algorithmic tools for hiring, recruitment, and other functions; and 75% of companies globally expect to adopt some form of AI.

Presentations on climate change

I have to leave out a discussion of many other papers presented in the URPE sessions and instead finish on discussing those on climate change. Frank Ulgen from Grenobles Alpes University suggested that curbing global warming could be achieved by adopting effective financial regulations that ensured ‘public good provisioning’ including investment in renewables etc to stop global warming. This seemed to me at the height of utopian thinking to reckon that regulation of the financial sector to fund ‘public goods’ would work.

In contrast, Robin Hahnel of the American University presented two controversial points. First, that those who advocate ‘de-growth’ were going down the wrong path for reversing global warming (see our book Capitalism in the 21st century pp 34-37). What was needed was democratic planning of economies to produce use values that can improve the environment, while ending the production of damaging products like fossil fuels. It was not a question of ‘less growth’ but of environmentally sustainable growth.

Hahnel’s second point was to argue against those socialists who reckon that nothing can be done about the climate unless capitalism is removed. He reckoned that “if anti-capitalists continue to stand on the side lines and preach to those fighting to prevent climate change before it is too late that their efforts are in vain because only economic system change can prevent climate change, they will weaken efforts to prevent climate change before it is too late, and by discrediting themselves damage prospects for eventually achieving economic system change as well.”

Hahnel claimed that “even at this late date, even while most economies remain capitalist, we can still prevent cataclysmic climate change before it is too late.” We need to campaign for an international carbon price market to avoid climate disaster. So global warming can be stopped “without replacing capitalism globally or in the United States, because that will take more time than we have to prevent climate change before it is too late.” I leave you to consider Hahnel’s arguments.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.