By Michael Roberts

Professor David Harvey is probably the best-known scholar of Marxist economics in the world. Over the years, Professor Harvey and I have engaged in debate and discussion on Marx’s law of value and Marx’s law of the tendency of the rate of profit to fall. Professor Harvey has always been sceptical of the relevance of Marx’s law of profitability in explaining regular and recurring crises of production and investment under capitalism. He prefers alternative explanations. In the past, I have debated with Professor Harvey on this in defence of the relevance, indeed the ultimate causal connection between crises in capitalism and Marx’s law.

You can read the substance of these debates here and also in the excellent book: The Great Financial Meltdown, systemic, conjunctural or policy created, edited by Turan Subasat. See in particular, Part Two on Crisis and Profitability.

Professor Harvey article on the mass of profit

Now Professor Harvey kindly sent me in advance an article that has been published in the New Left Review. The article is entitled ‘Rate and Mass’. In this article Professor Harvey spells out again in detail his argument for considering the mass of profit over the rate of profit in the analysis of crises. At one point, he says: “mainstream commentators are not alone in missing the import of mass. There is a long history of Marxist economists doing so, too—not least in work on the tendency for the rate of profit to fall.” And later he comments that “Michael Roberts’ studies of the consequences of a falling rate of profit, (are) absent any concern for the importance of the rising mass”, referencing my book The Long Depression.

Well, in my book, go to p26 and you will find me saying: “The underlying contradiction between the accumulation of capital and the rate of profit (and then a falling mass of profit) is resolved by crisis.” And again, on p27 I say “on each occasion,… a fall in the mass of profit led or coincided with a slump”. Indeed, for several pages in that section of the book, I outline the role of the mass of profit in booms and slumps and quote other sources.

What is at debate here? Marx spells it out in Volume One of Capital: “despite the enormous decline in the general rate of profit…the number of workers employed by capital i.e. the absolute mass of labour set in motion by it, hence the absolute mass of the surplus labour absorbed, appropriated by it, hence the mass of surplus value it produces, hence the absolute magnitude or mass of the profit produced by it, can therefore grow, and progressively so, despite the progressive fall in the rate of profit.” He then adds: “this not only can, but must be the case…. The same laws “produce both a growing absolute mass of profit, which the social capital appropriates, and a falling rate of profit.” And then Marx asks: How, then should we present this double-edged law of a decline in the rate of profit coupled with a simultaneous increase in the absolute mass of profit arising from the same causes?”

Marx’s analysis of profitability

As Marx explains, his law of profitability has a double-edge. As the rate of profit falls in a capitalist economy, it is perfectly possible, indeed likely, that the mass of profit will rise. It’s arithmetical really: a falling rate can still imply a rising mass. But a double-edge cuts both ways. As Marx goes on to explain in Volume 3 of Capital (chapter 13). “The two movements not only go hand in hand, but mutually influence one another and are phenomena in which the same law expresses itself….. there would be absolute over-production of capital as soon as additional capital for purposes of capitalist production = 0. at a point, therefore, when the increased capital produced just as much, or even less, surplus-value than it did before its increase, there would be absolute over-production of capital; i.e., the increased capital C + ΔC would produce no more, or even less, profit than capital C before its expansion by ΔC.” So the mass of profit can and will rise as the rate of profit falls, keeping capitalist investment and production going. But as the rate of profit falls, the increase in the mass of profit will eventually fall to the point of ‘absolute over-accumulation’, the tipping point for crises.

Nevertheless, Professor Harvey wants to argue that Marx saw the mass of profit as more important in any analyses of crises than the rate. I think the above quote shows that they are integrally connected, in Marx’s view. Crises erupt when the mass of profit drops, causing over-investment and overproduction, but that happens when the rate of profit falls sufficiently to cause a fall in the mass of profit.

Professor Hartley criticises ‘rate of profit’ theorists

Now in a You Tube video of a recent panel in New York entitled Anti-Capitalist Chronicles, https://www.youtube.com/watch?v=NVqPSF4IlfE, Professor David Harvey tells the audience of his latest views on China, imperialism and crises (see from about 50min). But then a little later, Professor Harvey makes a critical comment on the ‘rate of profit’ theorists, singling out me in particular (at about 1.08). After supporting Paul Sweezy and Baran’s rival ‘surplus profit thesis’ over Marx’s law of profitability, Professor Harvey remarks that Michael Roberts is obsessed with the rate of profit falling all the time and went on to joke: “if it started falling in 1850, should it not have reached zero by now!”

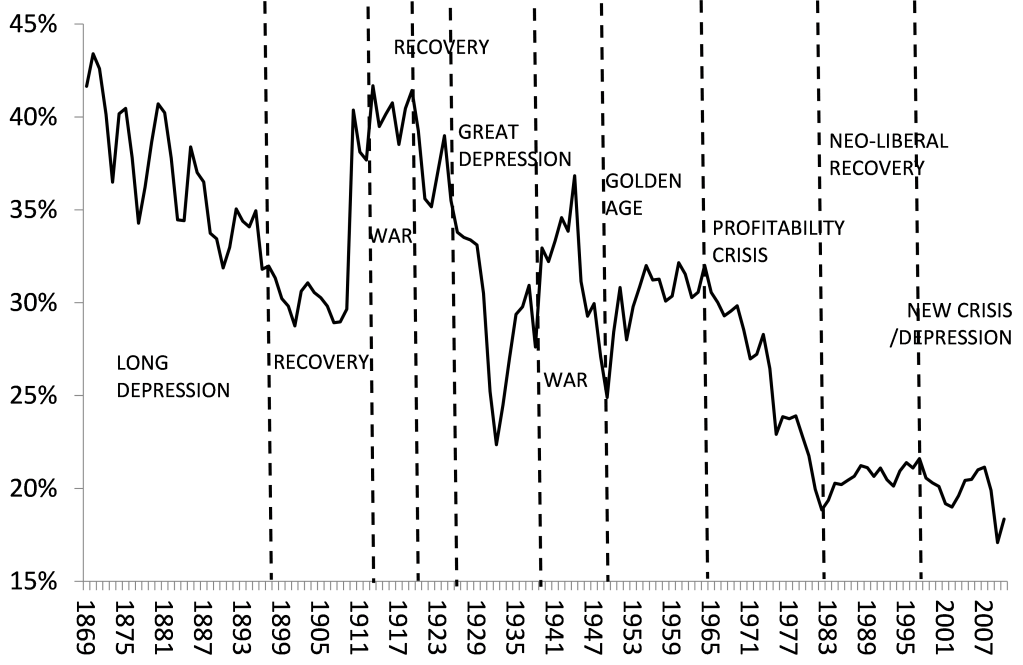

Amusing as this joke is, anybody that reads my material on the rate of profit knows that the world rate of profit has not fallen to zero and will not any time soon, if ever, although there is a long term secular fall in the rate. And there are several reasons for that, as I explain in my work. The first is that there are counteracting factors to the law of the tendency of the rate of profit to fall and these countertendencies can raise the rate of profit for whole periods, decades even, as they did from the early 1980s to the end of the 20th century. The other main reason is that regular slumps in capitalism lead to the devaluation of capital, with companies going bankrupt, writing off fixed assets and laying off workers. That leads to a rise in profitability possibly for several years. So there is a cycle of profitability – again something that I explain in detail in the Long Depression, for example. So the rate of profit does not fall in a straight line towards zero and Professor Harvey’s little joke at my expense does not hold to reality. You can see in this graph below how that pans out. Even if the rate of profit fell in a straight line from here, it would not reach zero before 2060 or so – and that won’t happen for the reasons above. Indeed, there are plenty of periods when the rate of profit rises, often after major world wars or after long periods of economic depression.

The chart below shows the world rate of profit (%) – from the work of Esteban Maito using 14 key countries.

In his presentation to the panel, Professor Harvey goes on to say that he challenged me personally about why I don’t ever talk about the mass of profit. Apparently, I replied: “oh, I talk about it, but it doesn’t really matter.” But that’s not how I remember the discussion. This discussion actually took place at a public session, a plenary debate between Professor Harvey and myself in front of over 200 people at the HM conference of 2019 in London, after Professor Harvey had sent me in advance a paper which follows the same arguments as in his article for the NLR above. Now I fully documented (accurately I think) this debate between me and David here. If you read this post closely, I think you will find the ‘challenge’ and my response was not quite as Professor Harvey portrayed it at the New York panel.

The double-edge law (rate and mass)

As I say in my post covering that debate with Professor Harvey back in 2019, “Indeed, we ‘falling rate of profit boys and girls’ have been well aware of Marx’s double-edge law (of rate and mass)”. And in my presentation to that plenary, I outlined the law; and I cited various works by ‘rate of profit’ theorists like Henryk Grossman who have used Marx’s double-edge law to explain crises. Indeed, Grossman’s whole argument is built around the view that eventually a falling rate of profit leads to a slowdown in the rise in the mass of profit to the point where there is not enough surplus value to sustain investment in production and take a share for their own living and breakdown follows.

And I provided a batch of empirical evidence showing the close connection between the rate and the mass of profit in leading to crises. For example, I refer to the work of Jose Tapia from Drexel University published in the book, World in Crisis, jointly edited by myself and G Carchedi, that shows the close connection between the changes in the mass of US corporate profits and investment, leading to successive crises. Indeed, at the plenary, I also provided a careful modelling of Marx’s double-edge law and applied it to real data from the US economy to show its connection to the Great Recession.

But more important than who said what and when, is what is the best explanation of the causes of regular and recurring crises under capitalism? In the post on the debate between DH and myself, I concluded that “I think Professor Harvey’s purpose (in his paper and now in his article) was to weaken the role of Marx’s law of profitability and its relevance to crises. By bringing up the double-edge law, it seems to me, David was saying that a rising mass of profit or capital stock or GDP is the problem. And thus, the problem for capitalism is not insufficient profit due to a falling rate, but too much surplus due to rising mass. How are we going to absorb or cope with ‘too much’ is apparently the problem? This connects with David’s view that crises under capitalism arise because of too much capital or profit relative to the ability of consumers to use it. Indeed, David argues that it is consumer confidence and the level of consumption that matters in triggering crises not the rate or level of profits and investment. But the evidence on that does not support David’s thesis as I have shown before.” (See the posts identified at the end).

The underlying cause of crisis

As readers of my blog will know, in the debates that I have had in the past with Professor Harvey, he rejects Marx’s law of profitability as the underlying cause of crises in favour of what he has called a multiplicity of causes (again see the posts below). He reckons those who focus on Marx’s rate of profit law are being ‘monocausal’. But he has had to admit that the empirical evidence of a falling rate of profit is compelling. So now he has moved the goal posts from the rate to the mass. But shifting the goal posts just leaves us with a new goal to score in.

Marx’s double edge law is not a refutation of the law of profitability as the underlying cause of crises; on the contrary, it is integrally connected. And alternative ‘multiple’ causes (like underconsumption, ‘too much surplus to absorb’, disproportion, financial fragility etc) remain unconvincing and unproven in comparison.

Here are links for the debate. I leave the readers of DH’s new piece and my response to make up their own minds.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.