By Michael Roberts

José Tapia has a new book on the world economy. Tapia is a professor of politics at Drexel University, Philadelphia, where he teaches courses on international political economy, political economy of climate change, social development, and political parties. With degrees in economics, medicine, and public health, he formerly worked for the Spanish social security system, the World Health Organization and the University of Michigan. In his many books and papers, in Spanish and English, he has made important contributions in health economics, understanding climate change and explaining capitalist crises – all from a Marxist viewpoint.

In his new book, Six crises of the world economy, he offers the reader a ‘big picture’ analysis of the world capitalist economy since the 1970s. Tapia identifies six crises in capitalist economies since the 1970s. The first crisis occurred in the mid-1970s and the sixth crisis occurred in 2020, at the time of the COVID-19 pandemic.

The basis of José Tapia’s theoretical approach

He bases his theoretical approach on what is called world systems theory, propounded by Immanuel Wallenstein and others. The view here is that we should not consider the nature of economic crises in capitalist production and investment at the level of the national economy, but instead from the dynamics of global production, investment and trade. As Tapia puts it: “the world economy, not national economies, is the major unit to be analysed when trying to understand the economic reality of our time, particularly the reality of crises.”

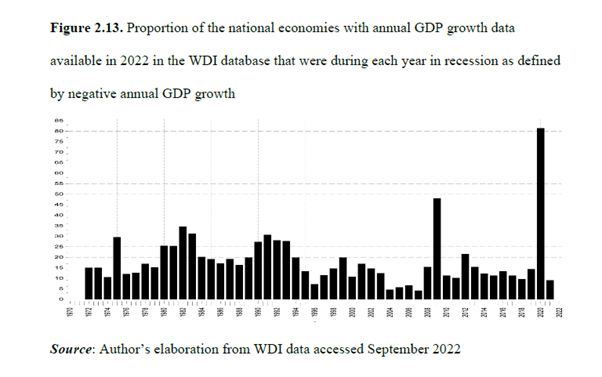

Tapia argues that this is particularly the case in the 21st century when all the economies of the world are now so integrated through trade and capital flows – ie no economy is an island on its own; on the contrary, the economic fortunes of the major economies, including the leading one, the US, are closely correlated. Tapia again: “Today we have a capitalist world-economy. It encompasses the entire globe, but there isn’t anything else […] It starts in the end of the 19th century, but it’s the first time in human history where there’s only one historical system on the planet at a given time. And that does change a lot of things.” Crises or downturns in the major economies are increasingly synchronized as those around the turn of the century, in 2008-2009 and in 2020 show. Indeed, in 2020, 85% or more countries suffered a reduction of real GDP, the highest proportion ever.

Tapia defines crises as “periods of substantial slowdown in world economic activity—as measured by investment, money value of the economic output, industrial production, trade, unemployment, etc.—in which many national economies, though not all, are technically in recession.”

Drawing on previous work by Mitchell and Tinbergen

Tapia draws heavily on previous work by non-Marxist economists Wesley Mitchell and Jan Tinbergen who, in his view, although mainstream economists, developed a theory of endogenous recurring capitalist crises from empirical studies. Their conclusions were dismissed or rejected by the mainstream because the mainstream denied that capitalist economies had cyclical fluctuations or at least crises that were endemic to capitalism. Mitchell’s explanation for these cycles was far too close to that of Marx. Mitchell: “where money economy dominates, natural resources are not developed, mechanical equipment is not provided, industrial skill is not exercised, unless conditions are such as to promise a money profit to those who direct production. the making of goods or to the satisfaction of wants […] Modern economic activity is immediately animated and guided, not by the quest of satisfactions, but by the quest of profits.” Swedish economist Jan Tinbergen reached similar conclusions to Mitchell.

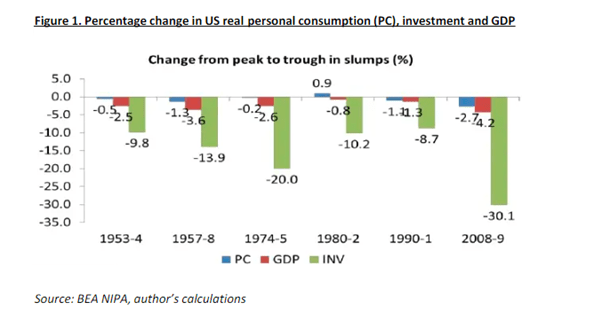

Tapia argues that Mitchell and Tinbergen were following Marx by saying and showing empirically that the movement in productive investment drove capitalist economies and that investment depended on the movement in the profits of accumulation. “Since the early studies on the business cycle, it is known that both consumption and investment grow in the upturn and fall in the downturn of the cycle, but investment is a more volatile variable and the drop in investment in the recession is more pronounced. Indeed, the share of consumption in GDP usually grows in recessions, as investment decreases sharply and GDP itself stagnates or shrinks.” When there was a sufficient reduction of average profitability, that would reduce investment leading to a collapse in production and demand so that a recession or crisis ensued.

The importance of the declining rate of profit prior to downturns

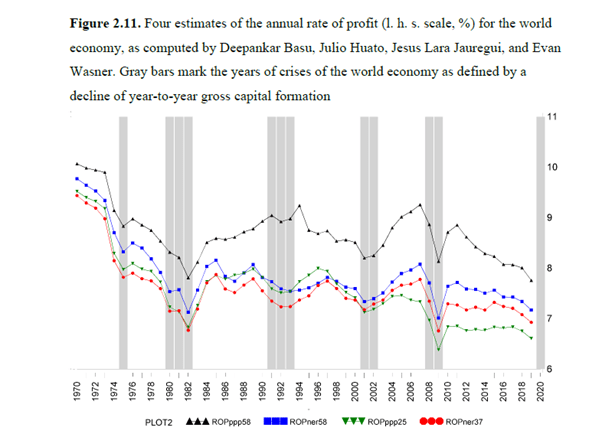

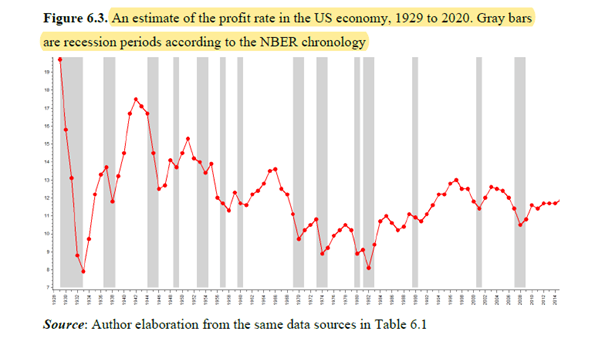

Tapia’s own work shows that the rate of profit on capital in the years immediately preceding the six crises that he identifies led to a fall in profits “that in turn leads to falling investment and the subsequent outflows of money toward speculative activities and hoarding have been repeatedly found at the level of national economies that profitability declines coinciding with every run into recession, for instance, profits peaked in 2007 and started to decline immediately before the Great Recession; after recovering in the early years of the next decade, they reached another peak in 2017 and since that year they started a decline that was indeed announcing a crisis when the economy was closed down by the COVID-19 pandemics.”

Tapia points out that many leftist economists, including Marxists, argued instead that the 2008-9 so-called Great Recession was one of a ‘Minsky moment’, named after post-Keynesian Hyman Minsky who claimed that crises or slumps were the result of financial speculation and excessive debt, and not a ‘Marxist moment’ due to any change in profitability. In a paper I have argued both theoretically and empirically against the Minsky explanation of the 2008-9 crisis. Tapia agrees: the Minskyites “did not consider that for instance in the US economy profits before and after taxes, and for nonfinancial and financial industries, had a peak in the third quarter of 2006, that is, quite before the financial crisis erupted.” These are my results below on consumption and investment in slumps.

For Tapia, profits lead investment, so he has little time for a theory of crises based on ‘underconsumption’, which is still the dominant theory of crises among Marxists. In Tapia’s view, underconsumption “theories have a scientific standard quite lower than other theories of the business cycle.” Joseph Schumpeter suggested something similar, asserting that underconsumption theory, “as Marx well knew, is beneath discussion since it involves neglect of the elementary fact that inadequacy […] of the wage income to buy the whole product at cost-covering prices would not prevent hitchless production in response to the demand of non-wage earners either for ‘luxury’ goods or for investment.” Underconsumption was not Marx’s theory of crisis: “in capitalist production what matters is not the immediate use value but the exchange value and, in particular, the expansion of surplus value. This is the driving motive of capitalist production.” (Marx).

Other variants of the under consumption theory

Tapia also has no time for a variant of underconsumption, popular among many Marxists, from the Bolshevik economist Maksakovksy, who argues that capitalist crises are the result of ‘overproduction’ (the flipside of underconsumption).

Tapia reckons that explanations of recessions as being caused by a lack of purchasing power due to a declining share of labour in national income—often proposed by radical economists in recent years—do not match the statistical evidence. Consumption, as well as labour income (wages and salaries), was increasing before the recessions of 2001 and 2008 and both variables have a stable rate of growth through the business cycle. I found the same thing.

No place for Keynesian ideas about “psychic” drivers for investment

As for Keynesian explanations of crises based on the ‘animal spirits’ of capitalists’ ie their ‘willingness’ to invest, he again turns to Mitchell: “business cycles are distinctly phenomena of a pecuniary as opposed to an industrial character. To dip beneath the business considerations relating to profit and loss, to deal with “psychic income” and “psychic cost,” even to deal with physical production and consumption in other than their pecuniary bearings, is to distort the problem. For the processes actually involved in bringing about prosperity, crises, and depression are the processes performed by businessmen in endeavoring to make money.”

And Tapia rejects the view of David Harvey and others that there is no common cause for crises in capitalism. “If that were the case, there is no need to look for explanations of the business cycle, a point of view that was rejected long ago and from very different quarters, for instance by monetarists, institutionalists, and Keynesians.” In other words, such an approach means there is no theory of crises and there never can be. This is a dereliction of scientific method. As Tapia says, “in social science to appeal to empirical data is always difficult and many authors theorize—wrongly in my view—that the most important thing is just to elaborate a logically consistent theory.”

Tapia turns to Mitchell and Tinberegen for his empirical evidence to ascertain a theory of crises, namely that the business cycle is an endogenous phenomenon of capitalism and changes in profitability are the key driver of that cycle. “From his regression analysis, Tinbergen had concluded that investment is an endogenous variable determined by previous profitability. Based not on regression results, but in a descriptive analysis of the data, Wesley Mitchell had arrived at a similar conclusion three decades earlier. But the conclusion of profitability being a key variable to explain the evolution of investment and the economy at large was largely at odds with the theoretical views of Keynes, Friedman, and Koopmans. Thus, it was discarded and even today is uncommon to read anything about profits in the explanations of mainstream economists about business cycles and crises.”

Tapia provides convincing empirical evidence

Tapia himself provides some of the best supporting empirical evidence to show that crises under capitalism happen because of the movement of investment and profits, and not from changes consumption or financial speculation. He has presented his evidence in several places, .

Tapia finds that: “In regression analysis of similar data of 275 quarters of the US economy, with rates of growth of profits and investment and the present value of one variable modeled as a function of the present and lagged values of the other variable, the present and lagged values of the rate of growth of profits before taxes explains close to half of the variation of the rate of investment, with the effect being positive and statistically significant in both quarterly and annual data analyses. In the other potential direction of causation, present and past values of investment explain about less than a third of the variation of present profits, with lagged values of investment having a negative effect which is statistically significant in the annual but not in the quarterly analysis.”

So the statistical evidence is in favour of a model in which changes in profitability lead and cause changes in investment—not the other way around as post-Keynesians like Kalecki or Goodwin argued. “Economic statistics show a decline of both total profits and the rate of profit immediately before crises, coupled with a subsequent drop in investment.” I too have found the same in my own statistical analysis – and so have those mainstream economists that have bothered to look at the relation between profits, investment and crises.

How do ideas of stagnation fit with the cycle of capitalist crises?

While Tapia sees crises in the world economy as endemic and therefore a recurring feature of capitalism, he does not see such crises having any particular regularity. Capitalism cannot escape recurring crises, but there is no pattern of regularity. In particular, Tapia does not like the word ‘depression’ to describe crises. For him (and he claims for Marx too), crises are only cyclical in nature and so stagnationist theories are not Marxist. The cycle can vary in length, but it is still a cycle, not a long stagnation or depression. Tapia argues that, contrary to Ricardo’s theory of a long-term fall in the rate of profit eventually leading to a final stage of stagnation, “Marx saw overproduction and a falling rate of profit triggering crises in which capital destruction and the increase in the rate of exploitation led to a recovery of the profit rate, and with it, a restart of the accumulation of capital. For Marx, permanent crises ‘do not exist’.”

According to Tapia, stagnation or depression theory has crept into Marxist explanations because of confusions created by Engels, “as in so many other things, Engels’ interpretation became ‘the Marxist truth’.” Tapia reckons that accepting Engels’ analysis means swallowing the stagnationist theses of post Keynesians like Kalecki or the Monthly Review School of Sweezy and Baran. This is misguided, says Tapia. “Engels’s suggestion that acute crises recurring approximately at decennial intervals had been displaced by protracted cycles and longer periods of depression does not fit with the empirical data of the last decades of the 19th century.” According to Tapia, there is no evidence to support Engels’ insight – capitalist production has had booms and slumps since the 1970s not a long-term decline. It has been a period of ceaseless accumulation of capital interrupted by temporary crises.

Defending Engel’s identification of ‘a permanent and chronic depression’ in 1886

Here I do not agree with Tapia. In my view, Engels’ so-called distortions of Marx’s theories is a myth – see my book, Engels 200. I do not think that Engels distorted Marx’s theory of crises with a stagnationist one. Engels wrote about ‘a permanent and chronic depression’ in 1886, right in the depth of the long 19th century depression that engulfed the major economies from about 1873-95. Surely, Engels was right in characterising that period as something different from the previous boom period from 1850-73, which still had a succession of crises?

Tapia criticises the stagnationists who reckon that after the 1970s, capitalism has just grinded downwards and he lumps my own view (expressed in my book The Long Depression) into stagnationist bloc. Let me defend myself. I do not agree with the likes of Robert Brenner and Monthly Review that capitalism entered a period of permanent stagnation from the 1970s. In my book, I argue that capitalist accumulation is both cyclical and secular in character i.e profitability rates can rise for a period of time, even decades, but then re-enter a period of decline – but within each of those periods, there are still shorter cycles of boom and slump. In the ‘neoliberal’ period from the early 1980s to the end of the 20th century, profitability, investment and real GDP growth picked up compared to the world profitability crisis from the mid-1960s to the end of the 1970s. Nevertheless, profitability eventually resumed its secular fall from the end of the 20th century – a period I call a Long Depression. Tapia’s own graph of US profitability since 1970 shows just that.

Tapia’s rejection of what he considers is stagnation theory also leads him to reject the idea of long cycles or waves (as originally proposed by Kondratiev and promoted by others like Ernest Mandel, Anwar Shaikh and myself). For him, K-waves are “a kind of Russell’s teapot, an entity whose existence cannot be disproved. My conclusion on K-waves is that the evidence in favour of its existence is no more convincing than the statistics William Stanley Jevons or Henry L. Moore provided more than a century ago to demonstrate that business cycles are linked to astronomical events. Without much effort and without any need to appeal to K-waves, all this can be interpreted as substantive evidence in favor of a long-term decrease in the rate of accumulation of capital, a long-term increase of the weight of the financial sphere in the global economy during recent decades, and a likely evolution of world capitalism toward more generalized crises.”

Debate over the acceptance of long term waves overlaying periodic recessions

Maybe – but Tapia dismisses too quickly some statistically sound work that suggests there are longer periods of upswing and downswing over and above the shorter cycles of boom and slump. Indeed, there are several works that lend support to the concept of longer cycles.

Why does this matter? Well, if there is good evidence for long cycles based on the movement of profitability over a few decades, I think that would help to explain where the world economy is going – is it in a period of growth and upswing (interspersed with slumps) or one of downswing where nothing much improves (see my book The Long Depression, Chapter 12). In my view, we are in the latter right now. But that does not rule out a new period of upswing in the future. It’s not some permanent stagnation.

Tapia’s contribution on carbon emissions and economic growth

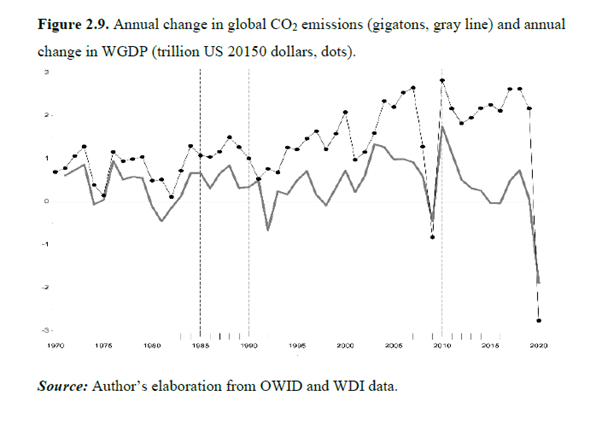

There are two more contributions that Tapia makes to understanding of modern crises. The first is the relation of economic growth to carbon emissions. Economic growth is directly linked to the growth of emissions; indeed, crises of the world economy are the only periods in the past half-century in which the steady growth in global emissions of CO2 has slowed down. For instance, when the world economy contracted by 0.83 trillion dollars in 2009, emissions of CO2 contracted by 0.46 gigatons. Even more dramatically, in 2020 the world economy contracted by 2.8 trillion dollars while emissions dropped by 1.9 gigatons.

The second contribution is that Tapia shows that in each period of expansion of capitalism there is a strong increase in the demand for raw materials and energy, raising their prices. Constant capital in Marxist theory includes circulating capital (raw materials etc) and not just fixed assets. There is a general law that the rate of profit varies inversely with the value of the raw materials (eg oil). (We take up Tapia’s insight in our book Capitalism in the 21st century. p16)

Tapia’s Six Crises is essential reading

In sum, Tapia’s Six Crises is essential reading for the evidence supporting Marx’s view that crises are endemic to capitalism and are now generalised through the world. Major economic crises occur at least once per decade and “the mostly failed attempt to create institutions of ‘global governance’ show quite clearly that the ability of the market economy to regulate itself and produce efficient social outcomes is just a myth.“

Tapia: “The internal dynamics of capitalism will continue generating economic crises and ecological destruction, stoking mass poverty, social unrest, and mass migrations. It looks quite clear that all these processes in the absence of a world government significantly increase the risk of a world war. Thus the choice is not between this system and a modification of it that is more stable and efficient, but between this system and another system that must necessarily be very different in order to at least allow a significant portion of the 8 billion human inhabitants of our planet to live in peace with themselves and with nature. “

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.