By Michael Roberts

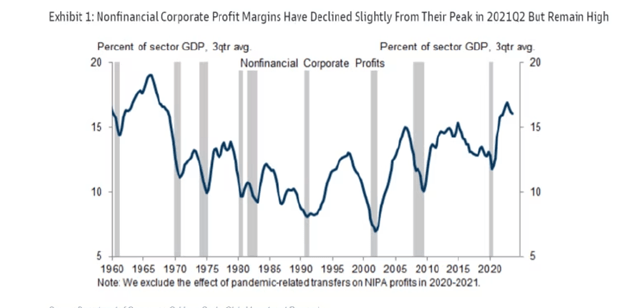

US corporate profit margins are at record highs, despite slowing price inflation and rising wage increases. Looking at the whole US economy, non-financial sector profit margins are at their highest level in the 21st century (over 16%) and not far short of the record levels of the ‘golden age’ of capitalist growth in the mid-1960s.

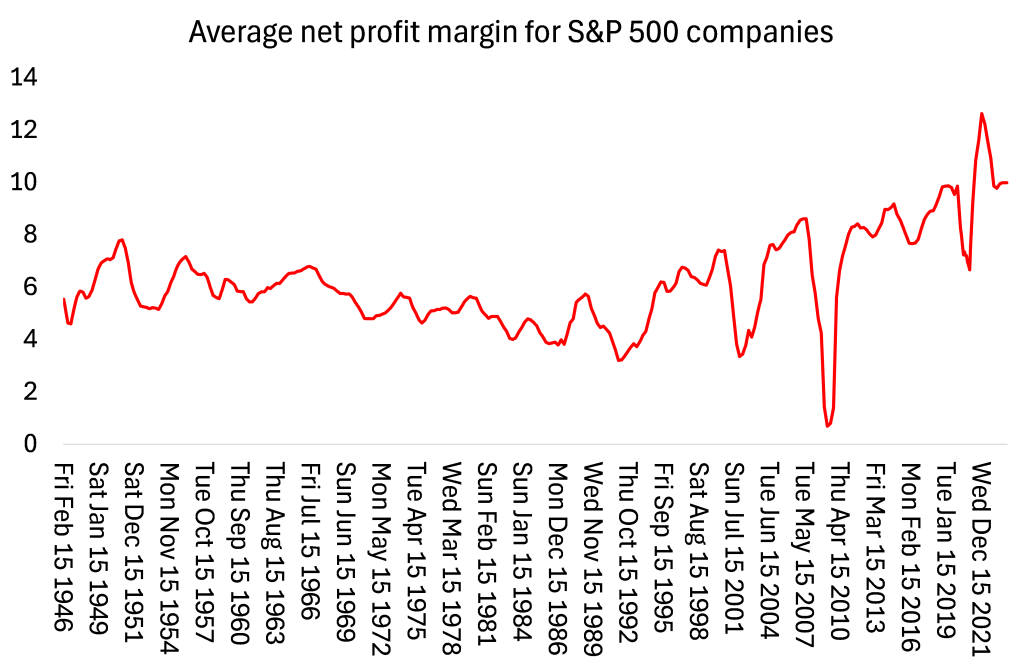

And just looking at the net profit margins (that’s after deducting all unit costs of production) for the top 500 companies in the US, it’s the same story.

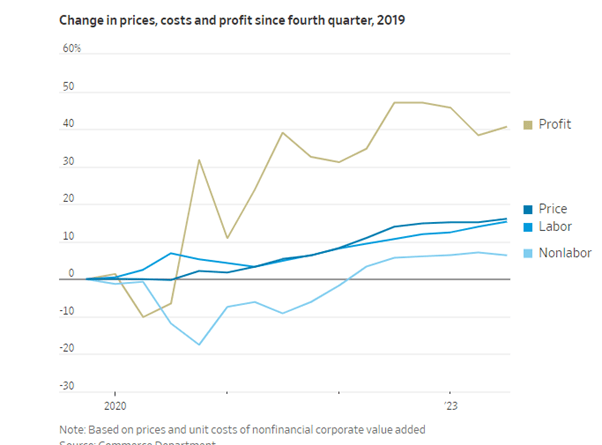

The evidence is overwhelming that the post-COVID inflationary spiral enabled many companies to hike the prices of their products considerably so that profit margins rose sharply because wage rises did not match price increases. Inflation bit into the living standards of most American households, but not into the profit margins of the US multi-nationals and mega firms.

Prices outweighed costs leading to a 41% rise in profits since 2019

Since the end of 2019, prices in the US are up 17%, outpacing both labour and nonlabour costs. The result: profits grew by 41%. If profits had grown at the same slower rate as costs, that would have translated to a cumulative price increase of only 12.5%, and an average annual inflation rate roughly 1 percentage point lower.

But recent research has confirmed that the rise in corporate profit margins “appears mostly driven by a subset of high-markup firms.” The now well-known Weber-Wasner thesis on profit-driven inflation suggests that supply chain bottlenecks crimped competition by leaving some firms unable to service demand. And that enabled some firms to hike margins and prices. A Bank of England study found that yes, profits rose a lot in nominal terms. But so did costs. The study concluded that, other than in oil, gas and mining, profit margins up to 2022 behaved pretty normally. Another study by the IMF studying the eurozone concluded that “limited available data do not point to a widespread increase in mark-ups”. Profit-driven inflation seems to have been highly concentrated in a small number of firms and a small number of ‘systemic’ sectors, including extractive industries, manufacturing, IT & finance.

Nevertheless, Goldman Sachs economists are ecstatic at the prospect of profit margins staying up. They reckon that, although average wages are now rising faster than price rises, that will not hit profit margins because as inflation slows, so will interest rates (eventually) and thus the cost of servicing debt will fall to compensate for any squeezing of profits by wages.

Indeed, FactSet, a company that monitors the earnings of the top 500 US companies, reckons that the net profit margin for Q1 2024 will be 11.5%, which is above the previous quarter’s net profit margin of 11.2% and equal to the five-year average of 11.5%, with seven sectors expected to report net profit margins in Q1 2024 that are above their five-year averages, led by the Information Technology setor (25.1% vs. 23.3%).

Profit margins are not the same thing as profits

Goldman Sachs concludes that the US economy is set fair for 2024 as margins will continue to hold up, generating more investment and sustaining employment. But while the tech sector with its high margins and profits holds up the stock market and gives the impression of a widespread leap forward in profits, the rest of the US corporate sector is in the doldrums. In most sectors, margins are tight.

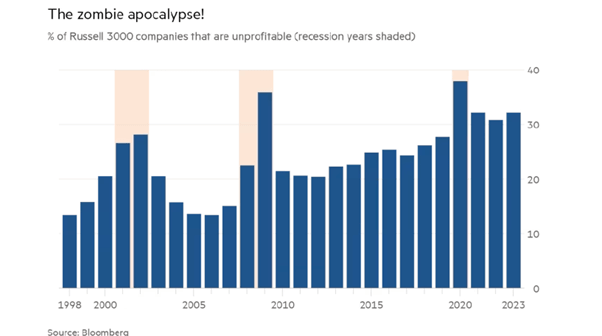

And most important, there is an issue of definition here. Profit margins are not the same as profits. Profit margins are the difference per unit of output between the price per unit sold and the cost per unit. But the profitability of capital should be measured by total profits against the total costs of fixed assets invested (plant, machinery, technology), raw materials and the wage bill. On that measure, outside of the ‘magnificent seven’ of US mega tech and social media corporations and energy companies, the rest of the US corporations are experiencing low profitability on their capital. Indeed, it has been estimated that 50% of quoted US firms are unprofitable.

And if we calculate the average rate of profit on US non-financial sector capital, we find that there has been a general decline since 2012 (2023 is my estimate).

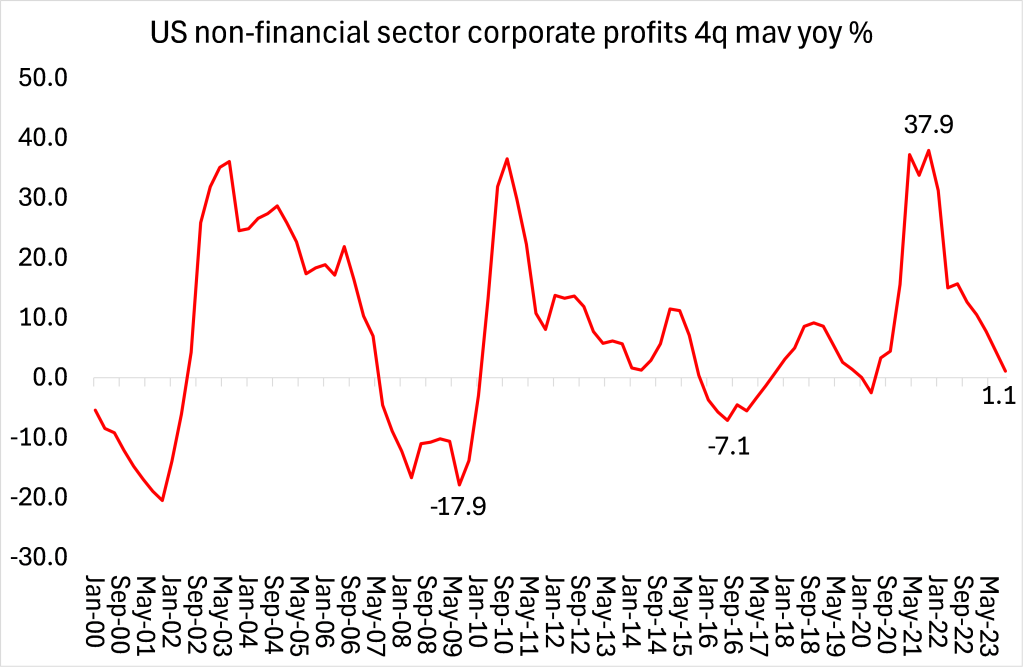

Profit margins may be high but total US non-financial sector corporate profits fell in the last quarter of 2023 and over last year, total profit growth has slowed almost to a stop.

And on another measure, total earnings (not margins) growth for the top 500 US companies is also slowing. FactSet forecast earnings in Q1 2024 to rise just 3.3%, down from near 6% in 2023.

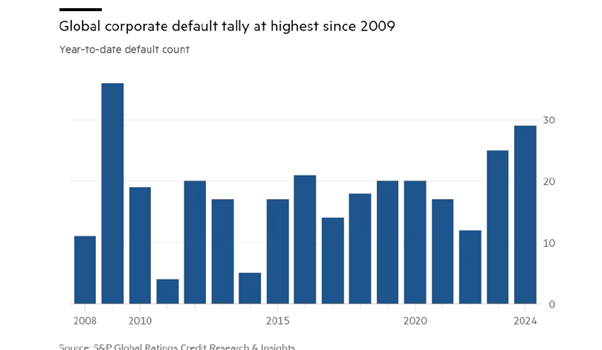

Slowdown in earnings has produced a rise in corporate defaults

That explains why more companies have defaulted on their debt in 2024 than in any start to the year since the global financial crisis as inflationary pressures and high interest rates continue to weigh on the world’s riskiest borrowers, according to S&P Global Ratings. This year’s global tally of corporate defaults stands at 29, the highest year-to-date count since the 36 recorded during the same period in 2009, according to the rating agency.

Goldmans remains confident that an improving macroeconomic outlook and hopes that interest rates will decline in the second half of the year will see default rates stabilize. The credit rating agency, Moody’s, is not so confident. It expects the global speculative-grade default rate to continue to increase in 2024 well above the historic average.

Zombie companies that cannot invest or expand

And don’t forget the ‘zombies’, companies that are already failing to cover their debt servicing costs from profits and so cannot invest or expand but just carry on like the living dead. They have multiplied and survive so far by borrowing more – so are vulnerable to high borrowing rates.

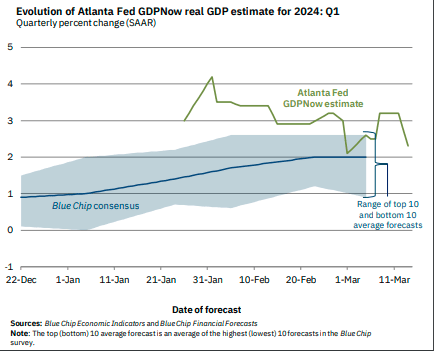

Looking ahead, US real GDP, by nearly all forecasts, is expected to slow from its 2.5% rise last year (and that measure is still dubious when we compare real GDP with real domestic gross income (GDI).

US real GDP growth expected to slow

The New York Fed Nowcast forecast is for 1.78% annualized in this first quarter of 2024 just ending. And the Atlanta Fed GDP Now forecast is around 2.2%. Consensus forecasts are for 2%. That suggests that corporate revenue growth could slow further, leading to a fall in profits in Q1.

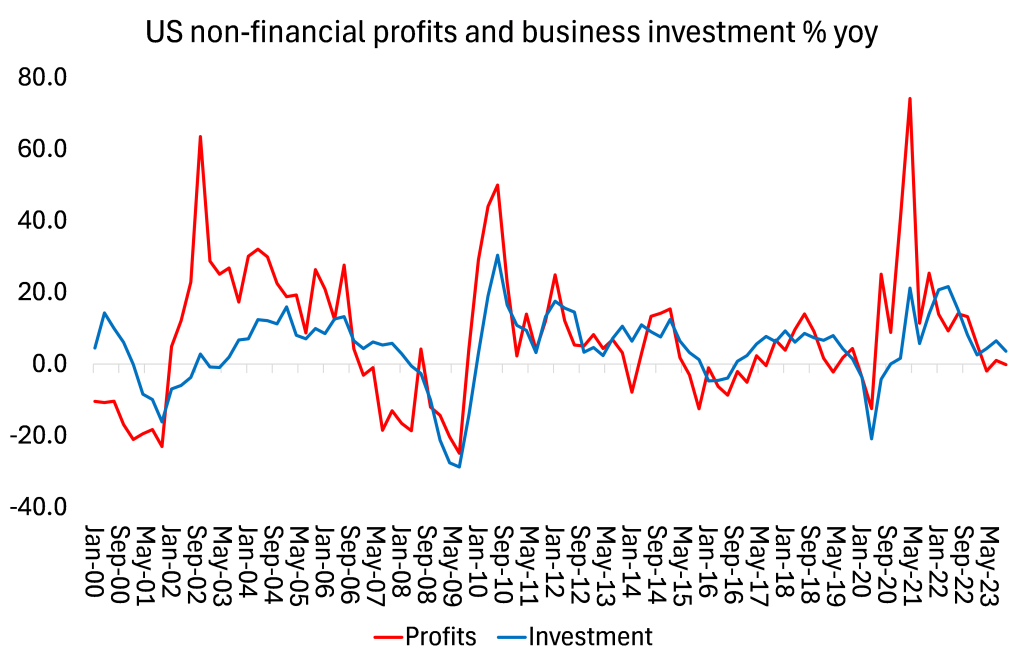

And remember, it is now well established that profits lead investment and then employment in a capitalist economy. Where profits lead, investment and employment follow with a lag.

Profitability has been falling from pre-pandemic levels and total profit growth has also stopped rising. Already that is having an effect on investment growth and employment. Rising margins do not show this.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.